Stimulus Update 4/21/20

If you’d rather watch than read, check out the YouTube version here!

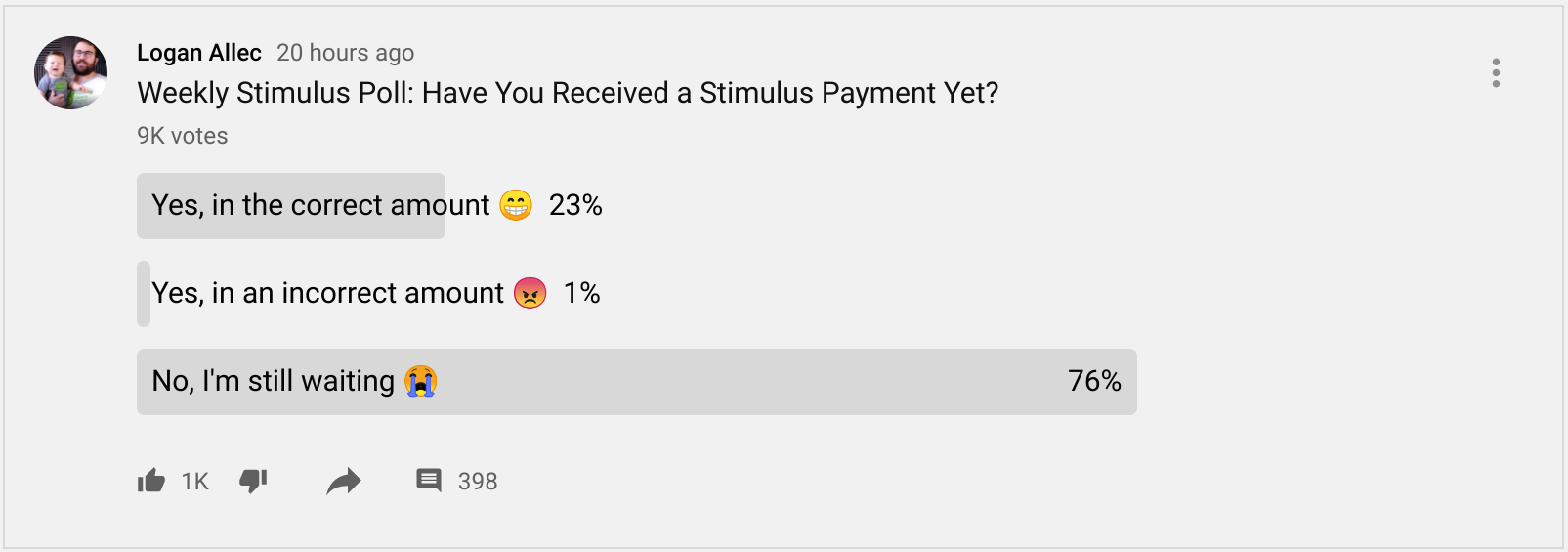

I took a poll yesterday of all of you, and 9,000 responded, thank you for that, I will do another one next week so we see the progress here, but wow, less than a quarter of those of you who responded have received a stimulus payment, sad, I was hoping that number would be higher but it looks like 23% received their stimulus in the correct amount, 1% in an incorrect amount, and the vast majority, 76% are still waiting.

Hopefully that 23% goes up to over 30%, 33% next week when I do this poll again.

Alright, so as I’ve been saying since it came out, you all know this, the IRS Get My Payment Tool has problems, but MetaBank out of Sioux Falls, South Dakota, put out a statement yesterday, that kind of gives us some clues to what banks are thinking right now, and basically this bank is basically saying, “Yeah, the Get My Payment Tool is wrong,” which gives us all some validation, right, that some $5 billion bank is basically seeing the same things that we are with the IRS right now.

I’ll tell you what Metabank said in a second, but just for context, so you remember that there are temporary accounts that the IRS uses for some individuals who who had fees taken out of their refund or had advances taken out of their refund, and these are bank accounts that the taxpayer really would have had no idea about in terms of account number, and last week the IRS attempted to make stimulus payments to these temporary accounts, and this bank MetaBank, which runs Refund Advantage, said that they have sent these payments back to the IRS.

So now MetaBank is saying, even though we rejected these payments last week to these temporary accounts, the IRS is telling people on the Get My Payment Tool, that they’re going to try to deposit the stimulus money to those same accounts again, this week, on April 24, there’s what MetaBank says: “We were very concerned to learn over the weekend that the messaging on the Get My Payment website is now telling customers their payments are scheduled to be distributed back to the same temporary refund transfer accounts at the end of this week (April 24), with no option to take any action.

This is NOT the direction that the IRS has given us. We believe the messaging was posted in error and we have communicated as such to the IRS.”

And this isn’t part of MetaBank’s statement, but I’m thinking this probably extends to other facets of the Get My Payment Tool, other things going wrong with that, if the IRS screwed this up, what else are they screwing up?

Some of you were asking about H&R Block, so H&R Block, similar thing, they use temporary accounts in certain situations when there’s a fee taken out of the refund or there’s a refund advance — same thing with TurboTax and others — and where’s what H&R Block said: “We have seen IRS send stimulus payments to temporary accounts for some of our clients.

As long as it is an open account, H&R Block is processing those and sending the payment to the client’s chosen disbursement — check, Emerald Card or external bank account. We have also seen IRS send stimulus payments directly to the ultimate destination account without it passing through the temporary account.”

So, and I’ve seen this in the comments too, some of you are saying, I got fees taken out of my refund through TurboTax or H&R Block or somewhere else, and I’ve already gotten my stimulus, and in other cases, people in the same situation are saying that they haven’t gotten their stimulus and they’re seeing funny business, wrong account numbers on the IRS website.

So, I mentioned this before, no rhyme or reason.

We have talked about how private debt collectors with a garnishment order, or banks at which you’re overdrawn, could theoretically seize stimulus payments when they’re deposited into your account, some states have protections in place to prevent this, but there is no nationwide, federal protection against this.

But apparently now the Treasury Department is reviewing whether it has the legal authority to do this, to prevent debt collectors and banks and other private entities from seizing the stimulus payment.

Nothing’s official here, and it looks like this was just an anonymous tip from a Treasury official.

Alright, IRS announced yesterday — and I covered this at the beginning of my video from yesterday evening where I interviewed former Social Security Adminstration Commissioner Michael Astrue — so yesterday the IRS said that Social Security retirement, SSDI, SSI, Railroad Retirement Benefits, and Veterans benefits recipients with dependent children under the age of 17 need to file on the IRS portal for non-filers to report these children so they get the $500 for them, and they need to do so by tomorrow, Wednesday, April 22, at 12:00 noon Eastern Time, or else they won’t get a stimulus payment for them, and the only way they could get the $500 for them would be to file a 2020 tax return and claim the credit on there.

And obviously these are people who don’t normally file a tax return, and I don’t want you to have to file a tax return next year to get the $500 for those dependent children, so be sure to use the IRS portal for non-filers by noon tomorrow, Eastern Time, if you’re in that position.

Before I get into the questions, I saw some clickbaity article on Fast Company yesterday called “Dark patterns could keep you from getting your stimulus check,” ooo dark patterns, what does that mean, and the whole article is basically implying that TurboTax is being shady with its stimulus registration product by trying to steer users who use their stimulus registration product toward their paid products?

I went through the whole TurboTax thing, and I didn’t see any of that, I honestly thought they were pretty straight-up with their “stimulus edition,” you know.

This isn’t to say that in their normal free edition, they do try to upsell you for audit protection and some other stuff you probably don’t need if you’re filing a free tax return, and I cover that in my TurboTax review that I did earlier this year, but in my opinion the TurboTax stimulus edition didn’t appear to try to upsell you to paid editions unless you actually are required to file a tax return, in which case the TurboTax stimulus edition isn’t for you anyway, so.

What else, so apparently today the Senate should vote, and according to some, approve a $450 billion stimulus package for small businesses, hospitals, and coronavirus testing.

Right, and this bill for small businesses and others, that’s been Congress’s focus right now, that’s why there hasn’t been a whole lot of talk right now about future stimulus checks, for people, not loans for businesses, but hopefully after this $450 billion stimulus for businesses is passed, hopefully today in the Senate and signed by President Trump, the focus will once again become how can we help all you non-business owners out there (not that $450 billion is going to help small businesses that much anyway, that money will go like that).

Now, let us move on to stimulus questions.

[accordion id=”34932″]

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Reading your article helped me a lot and I agree with you. But I still have some doubts, can you clarify for me? I’ll keep an eye out for your answers.

I read your article carefully, it helped me a lot, I hope to see more related articles in the future. thanks for sharing.