THE SYSTEM IS BROKEN

This is your stimulus update for April 18, 2020.

Don’t want to read? Watch the video here!

People Getting “Payment Status Not Available” Error then Getting Stimulus

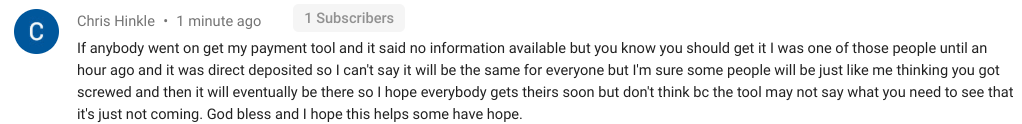

So first thing I want to say, just to offer a little bit of hope, and I obviously haven’t independently verified this, this is not on the IRS website, I’m not seeing media outlets report this, but many of you commenters have told me that they saw the Payment Status Not Available message on the Get My Payment Tool, and then a few hours later they got their stimulus payment. Go figure.

So on the one hand, that’s great. I’m glad you got your stimulus, Chris Hinkle, LoloRandom, and several others.

But on the other hand, this just goes to show how dysfunctional the IRS Get My Payment Tool is.

You’d think that if someone was going to get their stimulus check via direct deposit today, the IRS Get My Payment Tool would tell them and wouldn’t have the “Payment Status Not Available” error.

But of course the silver lining to all this is that even if you get that “Payment Status Not Available” message, you might not have to be concerned too much.

But the scary thing is this “Payment Status Not Available” message could possibly mean, per the IRS, that you’re not eligible for a payment.

And this goes back to my point yesterday about just, look, I get it, IRS has had a lot to do, I acknowledged that, but please don’t give the same messaging to people who are completely eligible for their stimulus and are going to receive it shortly, don’t give those people the same message that you give to those who are not eligible for a stimulus payment.

People Who Need Stimulus the Least Seem to Be Getting It the Fastest

I’m just getting really pissed because it’s seeming to me that the ones who are getting their stimulus payments the easiest and with the least amount of confusion are the ones who need it the least, and the ones who need it the most are the ones the IRS has caused the most confusion for.

And this isn’t a hard-and-fast rule, I’m not saying that if you received your stimulus this week that you didn’t really need it, I’m not saying that to Chris or to LoloRandom or anybody in particular, this is just a general observation, not a scientific fact.

I did an informal poll of my friends about who’s received their stimulus payment.

And generally speaking, there were exceptions to this, but the ones who got their stimulus payment this week with no confusion were the ones who are more or less comfortable, the ones who weren’t even worrying about it, really, the ones for whom an extra $1,200 or $2,400 or $2,900 popped up in their bank account, and it’s just money they don’t need and they’re probably just going to throw it in their Vanguard index funds or a savings account.

Like I’m thinking in particular of a friend I have who’s in engineering with a company you would all know, and based on some quick Google searches of his title and the company he works for I’d estimate he makes about 120 a year, married, wife stays at home with their kid, great family. He let me know he got $2,900 on Wednesday.

Meanwhile, many of the ones who need their payment the most are the ones who have not yet received it and are in fact the most confused about it right now and are getting this stupid “Payment Status Not Available” error.

I’m thinking in particular of individuals who don’t make enough to be required to file a tax return.

Cause if you don’t make enough money to file a tax return, you’re pretty broke, and I hope that’s not offending anybody, because you probably know you’re broke, because you feel it every day, and I feel for you, and I see the comments, you know, I’m down to my last fifty bucks, and I know you had to jump through some hoops with the TurboTax “stimulus edition” or the drunkenly-named “Non-Filers: Enter Your Payment Info Here” application, which just rolled out a week before yesterday.

And now because the IRS probably hasn’t processed that yet, they might have accepted it, but who knows if they’ve processed it yet for stimulus purposes, you’re getting these confusing messages on the IRS Get My Payment Tool like “Payment Status Not Available”.

Meanwhile my engineering friend who probably pulling 120 a year at least, stay-at-home wife, kid, beautiful little family, comfortable, filed his super easy tax return with TurboTax right when he got his W-2, took him all of ten minutes this past February, and he got his stimulus direct deposited, easy-peasy, on Wednesday, and he’s basically forgotten about it today.

Now I don’t begrudge the fact that he got a stimulus, that’s great for him, but why is he getting it before the people who need it the most?

And we also have SSI and Veterans Benefits recipients just receiving clarification this week about whether or not they will receive their payments automatically when people making six figures already got their check that they really didn’t need in the first place.

It’s all backwards, it’s all backwards, and the system is broken.

And I wish I had all the answers in terms of timeline, people ask in the comments, they say, hey, this is my situation, when am I going to get my stimulus? I’ve provided the timelines previously, but as we’ve seen this week, who knows, you know, right?

I mean, theoretically the IRS knows, but I don’t think they really know, I think they’re just flying by the seat of their pants, quite frankly, and I think the timeline will work for many people, but as we’ve seen this week, some people will apparently be left in the lurch.

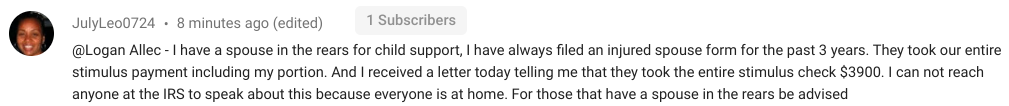

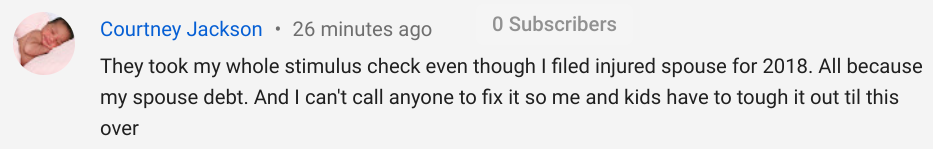

IRS Apparently Not Respecting Injured Spouse Allocation for Stimulus Purposes

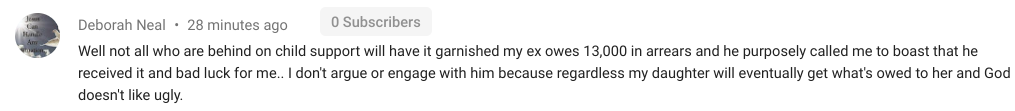

Also another thing I learned from commenters is that it appears that the IRS is screwing people by taking the entire stimulus, both for Spouse A and Spouse B, for those married to those behind on child support, even though they filed injured spouse previously.

And clearly, it’s not supposed to be this way. This is contrary to what the IRS has said on the matter.

And of course there’s no one to reach. And if they could reach somebody at the IRS, they’d probably just be told to file another injured spouse form just for the stimulus — which they shouldn’t have had to do in the first place.

Meanwhile, according to others, apparently some people who owed child support got a stimulus payment.

And again, this is just from commenters on my video yesterday. I haven’t really seen any media reporting this stuff, but I believe you all.

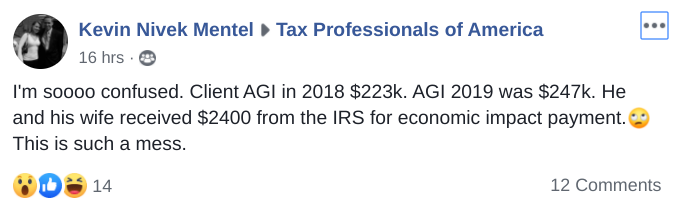

Clearly Unqualified People Getting Stimulus Payments

And look at this, this is my last thing before I get into the questions, I’m in a CPA Facebook group, and one of the CPAs, this isn’t a YouTube comment, so I blurred out the name and stuff, but he said, and I have no reason to think this guy is making this up, I’ve seen him post before, but he claims that a couple, and I assume they don’t have qualifying children, who made $223,000 in 2018 and $247,000 in 2019 got a nice little $2,400 surprise.

Meanwhile those on their last fifty bucks are being shown, “Payment Status Not Available.”

My point is, and you’re probably getting tired of me saying this, but my point is that this whole system is broken.

I’ve probably talked too much, just like yesterday, but now on to the questions.

I made too much to qualify for a stimulus in 2018. In 2019, I am in the phaseout range. What can I do to lower my income to qualify for a full stimulus payment?

So I went over this in the very first stimulus video I did when the CARES Act passed, but by phaseout range what this individual means is they make more than the amount for his or her filing status to qualify for the full stimulus payment.

You’ve heard the max income a single person can have to get the full stimulus of $1,200 for them, excluding children, is $75,000.

And then their maximum stimulus is reduced by five cents on the dollar for every dollar of income over $75,000.

So if this individual has $80,000 of income, the difference between $80,000 and $75,000 is $5,000.

$5,000 times 5 cents on the dollar is $250.

So their maximum stimulus they could get as a single individual with no children is $950, which is $1,200 minus $250.

So the individual is asking, “What are strategies I could implement in order to qualify for the full $1,200 stimulus check?”

That’s a great question, probably the easiest one is to contribute to a Traditional IRA, but if this is the only trick up your sleeve, this wouldn’t work if you’re already covered by a retirement plan at work because in 2019 if you are covered by a retirement plan at work and you make more than $74,000 excluding any potential IRA deduction, then you don’t qualify to take a deduction for your Traditional IRA contributions.

But if you do qualify to take a deduction for a Traditional IRA contribution, know that the deadline to contribute for tax year 2019 has been extended to July 15, 2020. In a normal year it would have been April 15, but the IRS extended it to July 15 this year along with the 1040 deadline and a ton of other deadlines.

And remember, contribution limit is $6,000 for tax year 2019 if you’re under the age of 50 and $7,000 if you’re 50 or older. So if you make $80,000 and your single, no kids, you max out your Traditional IRA, you can bring your income down to $74,000 to qualify for the full stimulus.

And I would also say if you’re a gig worker, freelancer, you have side income you’re reporting on Schedule C, be aggressive with your deductions, I’m not saying to make stuff up, but don’t be afraid to write stuff off, you know. Home office if you qualify, if you use an area in your home regularly and exclusively for your business, not your job, for your business, take that.

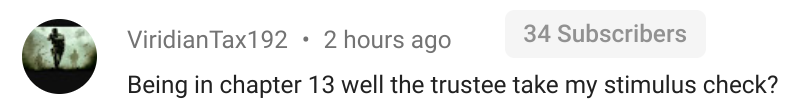

Will my stimulus be included in my bankruptcy estate?

So ViridianTax192 asked a great question that I haven’t covered yet: if I’m currently filing for Chapter 13 bankruptcy, will the bankruptcy trustee take my stimulus check?

Now, if you don’t know how Chapter 13 bankruptcy works, it’s different than Chapter 7, and I think Chapter 7 is what many people associate bankruptcy with: it’s like the Monopoly image, sell all your property, pay off your debts, and the rest is discharged, that’s Chapter 7, and that’s if you’re really broke, very little cash flow, very little income.

Chapter 13, you don’t sell all your stuff, you set up a repayment plan to your creditors over three to five years, and an appointed bankruptcy trustee, that’s an individuals, oversees the administration of this repayment plan, typically the payments are made to the trustee, who then disburses the money to the creditors according to the plan, and then after you’ve completed this repayment plan, your debts are discharged.

So what ViridianTax192 is asking is, hey, can my trustee make my stimulus payment part of my bankruptcy estate to be included in the repayment plan to my creditors?

Now, I’m just speaking federally here, there’s nothing in the CARES Act preventing the bankruptcy trustee from requiring the stimulus payment to be made part of your repayment plan to repay to your creditors, and in fact they have an incentive to do that since the trustee is generally paid a percentage of assets distributed.

So it’s possible.

However, the United States Trustee Program, this is the USTP, that’s the part of the Department of Justice that oversees bankruptcy trustees, said in a notice to trustees: “the United States Trustee expects that it is highly unlikely that the trustee would administer the payment after consideration of all relevant circumstances.”

So they’re basically discouraging trustees from including the stimulus in the bankruptcy estate.

Now, states may have various bankruptcy exemptions that you could use, possibly, but I’m not an attorney, and that’s probably too granular for this video, so I’m going to leave it at that.

I’m on Social Security and get my benefits on my Direct Express card. Will I get my stimulus on my Direct Express card?

Yes, you will, at least according to the Social Security Administration.

But here’s the confusion, what if you filed a tax return with a bank account but you get your benefits on Direct Express, which will the IRS use?

I can’t give you a straight answer here. And the way the IRS has handled things, I wouldn’t surprised if it was 50/50, if someone in your situation would get it on Direct Express, and then you get it to your bank account, it’s really anybody’s guess right now with this stuff.

I would say, try to use the Get My Payment Tool, I know it’s not working for everybody, and I’ve been crapping on it a lot, but some people have had success accessing it to get the details about where their payments going, so be diligent, continue to try to access the Get My Payment tool.

And it’s the same thing with the TurboTax card and the H&R Block Emerald Card, there’s no rhyme or reason here, I’m seeing commenters saying, hey, I got a fee taken out of my refund, and I got my stimulus just fine.

But then others in the exact same situation are not fine, and they’re not getting their stimulus. Go figure.

Anyway, gosh I’m trying to keep these not too long, because I know people don’t necessarily watch the whole thing, but the question they need answered is at the end, but hey happy Saturday, you all, enjoy your weekend, keep trying that Get My Payment tool, and don’t stress, alright? I’ll see you tomorrow.

I all the time used to read article in news papers but now as I am a user of internet so from now I am using net for posts, thanks to web.

Hello there, You have done a fantastic job. I will definitely digg it and personally recommend to my friends. I am sure they will be benefited from this web site.

Thank you for the auspicious writeup. It actually was a entertainment account it. Glance complex to far added agreeable from you! By the way, how can we keep in touch?

I am sure this article has touched all the internet people, its really really nice article on building up new website.

Hey there! Do you know if they make any plugins to help with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good results. If you know of any please share. Thank you!

Great web site. A lot of useful information here. I’m sending it to a few pals ans also sharing in delicious. And naturally, thank you for your effort!

Hi mates, how is everything, and what you wish for to say concerning this article, in my view its in fact remarkable in favor of me.

Hey! I know this is somewhat off-topic but I had to ask. Does running a well-established blog like yours take a massive amount work? I’m completely new to blogging but I do write in my diary on a daily basis. I’d like to start a blog so I will be able to share my experience and views online. Please let me know if you have any ideas or tips for new aspiring bloggers. Appreciate it!

Hmm is anyone else experiencing problems with the images on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any feed-back would be greatly appreciated.

Normally I do not read article on blogs, however I wish to say that this write-up very forced me to take a look at and do so! Your writing taste has been amazed me. Thank you, quite great article.

I simply could not leave your site prior to suggesting that I extremely enjoyed the standard information a person supply in your visitors? Is going to be back regularly in order to check out new posts

Greate article. Keep writing such kind of information on your page. Im really impressed by your site.

hey there and thank you for your information I’ve definitely picked up anything new from right here. I did however expertise a few technical issues using this site, since I experienced to reload the web site a lot of times previous to I could get it to load properly. I had been wondering if your web hosting is OK? Not that I am complaining, but sluggish loading instances times will often affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your respective fascinating content. Make sure you update this again soon.

I love it when people come together and share views. Great blog, continue the good work!

Unquestionably believe that which you stated. Your favorite justification appeared to be on the internet the simplest thing to be aware of. I say to you, I definitely get irked while people consider worries that they plainly do not know about. You managed to hit the nail upon the top and also defined out the whole thing without having side effect , people can take a signal. Will likely be back to get more. Thanks

Have you ever considered about including a little bit more than just your articles? I mean, what you say is fundamental and all. Nevertheless think of if you added some great graphics or video clips to give your posts more, “pop”! Your content is excellent but with images and clips, this website could certainly be one of the most beneficial in its niche. Superb blog!

I know this if off topic but I’m looking into starting my own blog and was wondering what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet savvy so I’m not 100% positive. Any tips or advice would be greatly appreciated. Cheers

Hi, yes this article is truly nice and I have learned lot of things from it concerning blogging. thanks.

Piece of writing writing is also a fun, if you be acquainted with after that you can write or else it is difficult to write.

Very nice write-up. I certainly love this website. Continue the good work!

My family members all the time say that I am wasting my time here at net, except I know I am getting experience every day by reading such nice articles.

I like the valuable information you supply on your articles. I will bookmark your weblog and check again here frequently. I am quite certain I will be told lots of new stuff right here! Good luck for the following!

You really make it seem so easy together with your presentation however I in finding this topic to be really something which I feel I would never understand. It sort of feels too complicated and very vast for me. I am looking forward on your next post, I will try to get the hang of it!

For most up-to-date news you have to visit world-wide-web and on internet I found this web site as a most excellent web site for most recent updates.

Incredible! This blog looks exactly like my old one! It’s on a completely different topic but it has pretty much the same layout and design. Wonderful choice of colors!

I read this article fully concerning the comparison of newest and preceding technologies, it’s remarkable article.

I don’t even know the way I stopped up here, however I assumed this post was good. I don’t recognise who you are however definitely you are going to a famous blogger if you are not already. Cheers!

I’m gone to inform my little brother, that he should also pay a visit this weblog on regular basis to take updated from most up-to-date news.

This is a topic that’s close to my heart… Take care! Where are your contact details though?

Aw, this was an extremely nice post. Finding the time and actual effort to make a great article but what can I say I procrastinate a lot and never seem to get anything done.

С Lucky Jet каждая минута может принести прибыль! Зайдите на официальный сайт 1win, чтобы начать играть и выигрывать.

Выберите Лаки Джет для быстрого азартного развлечения или стратегического заработка через официальный сайт lucky jet 1 win.

Nice post. I learn something new and challenging on sites I stumbleupon every day. It will always be interesting to read content from other writers and practice a little something from their sites.

I always spent my half an hour to read this website’s articles everyday along with a cup of coffee.

Keep on working, great job!

What’s up friends, how is everything, and what you wish for to say about this post, in my view its actually remarkable designed for me.

What’s up i am kavin, its my first time to commenting anywhere, when i read this post i thought i could also make comment due to this brilliant piece of writing.

Hello! Someone in my Myspace group shared this site with us so I came to give it a look. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Great blog and brilliant style and design.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why waste your intelligence on just posting videos to your site when you could be giving us something enlightening to read?

What’s Taking place i’m new to this, I stumbled upon this I have found It positively helpful and it has helped me out loads. I hope to give a contribution & assist other users like its helped me. Good job.

What’s up, I wish for to subscribe for this weblog to get latest updates, so where can i do it please assist.

This website definitely has all of the info I wanted about this subject and didn’t know who to ask.

Oh my goodness! Incredible article dude! Thank you, However I am going through issues with your RSS. I don’t know why I can’t subscribe to it. Is there anyone else getting the same RSS problems? Anyone who knows the solution will you kindly respond? Thanx!!

We stumbled over here from a different website and thought I may as well check things out. I like what I see so now i’m following you. Look forward to checking out your web page yet again.

Hi to every one, since I am actually keen of reading this weblog’s post to be updated daily. It contains nice information.

An interesting discussion is worth comment. I believe that you ought to write more on this subject, it might not be a taboo subject but generally people do not discuss such subjects. To the next! Many thanks!!

Can I just say what a relief to discover someone who truly knows what they’re talking about on the web. You definitely understand how to bring an issue to light and make it important. More and more people need to read this and understand this side of the story. I can’t believe you’re not more popular because you definitely have the gift.

Hi there, just wanted to mention, I liked this post. It was inspiring. Keep on posting!

Have you ever considered about including a little bit more than just your articles? I mean, what you say is valuable and all. Nevertheless just imagine if you added some great photos or video clips to give your posts more, “pop”! Your content is excellent but with images and video clips, this website could certainly be one of the greatest in its niche. Superb blog!

Howdy just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Chrome. I’m not sure if this is a format issue or something to do with web browser compatibility but I thought I’d post to let you know. The style and design look great though! Hope you get the problem resolved soon. Kudos

Simply wish to say your article is as amazing. The clearness on your post is simply nice and i can assume you are a professional in this subject. Well with your permission allow me to take hold of your RSS feed to stay up to date with forthcoming post. Thank you one million and please keep up the gratifying work.

all the time i used to read smaller articles which also clear their motive, and that is also happening with this article which I am reading here.

What i do not realize is if truth be told how you’re not really a lot more smartly-favored than you may be right now. You are so intelligent. You recognize therefore significantly when it comes to this topic, produced me personally consider it from so many numerous angles. Its like men and women don’t seem to be fascinated until it’s something to accomplish with Woman gaga! Your personal stuffs nice. All the time care for it up!

For most recent news you have to pay a visit world-wide-web and on world-wide-web I found this web site as a best site for latest updates.

Undeniably consider that that you stated. Your favourite justification appeared to be at the internet the simplest thing to understand of. I say to you, I definitely get irked at the same time as other people consider worries that they plainly do not recognise about. You controlled to hit the nail upon the top as smartly as defined out the whole thing with no need side effect , other people can take a signal. Will likely be back to get more. Thank you

Having read this I thought it was really informative. I appreciate you finding the time and effort to put this short article together. I once again find myself spending a significant amount of time both reading and leaving comments. But so what, it was still worth it!

What a stuff of un-ambiguity and preserveness of precious experience concerning unexpected feelings.

I am regular reader, how are you everybody? This article posted at this web site is in fact nice.

I quite like reading through a post that will make people think. Also, thanks for allowing for me to comment!

Do you have a spam issue on this website; I also am a blogger, and I was curious about your situation; many of us have created some nice procedures and we are looking to trade strategies with other folks, why not shoot me an e-mail if interested.

Incredible points. Outstanding arguments. Keep up the amazing work.

We stumbled over here coming from a different web page and thought I might check things out. I like what I see so now i’m following you. Look forward to going over your web page for a second time.

What’s up, I desire to subscribe for this webpage to take newest updates, so where can i do it please assist.

Can you tell us more about this? I’d like to find out more details.

Hi there everybody, here every one is sharing such experience, so it’s good to read this blog, and I used to pay a visit this blog every day.

WOW just what I was searching for. Came here by searching for %keyword%

This site definitely has all of the info I wanted about this subject and didn’t know who to ask.

I am really loving the theme/design of your weblog. Do you ever run into any web browser compatibility problems? A small number of my blog audience have complained about my website not operating correctly in Explorer but looks great in Chrome. Do you have any suggestions to help fix this issue?

My programmer is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using Movable-type on a number of websites for about a year and am worried about switching to another platform. I have heard great things about blogengine.net. Is there a way I can transfer all my wordpress content into it? Any kind of help would be really appreciated!

Ищете решение для ремонта? Механизированная штукатурка с mehanizirovannaya-shtukaturka-moscow.ru – это быстро, качественно и без пыли.

Получите безупречные стены благодаря услуге штукатурка стен на mehanizirovannaya-shtukaturka-moscow.ru. Качество и скорость исполнения вас удивят.

Hey there, You have performed a great job. I will definitely digg it and in my opinion recommend to my friends. I am sure they will be benefited from this web site.

Hurrah! At last I got a webpage from where I be able to in fact get useful information regarding my study and knowledge.

For latest news you have to visit world wide web and on internet I found this web site as a best site for most recent updates.

Если вы заботитесь о качестве и скорости работы, посетите наш сайт mehanizirovannaya-shtukaturka-moscow.ru. Мы предлагаем услуги механизированной штукатурки для идеально гладких стен.

There is definately a lot to learn about this topic. I like all the points you made.

I am extremely inspired with your writing talents and alsowell as with the layout for your blog. Is this a paid subject or did you customize it yourself? Either way stay up the nice quality writing, it’s rare to peer a nice blog like this one nowadays..

I go to see daily some websites and websites to read posts, but this blog offers quality based posts.

Hi, i think that i saw you visited my website so i came to return the favor.I am trying to find things to improve my website!I suppose its ok to use some of your ideas!!

Greetings from Los angeles! I’m bored to tears at work so I decided to check out your website on my iphone during lunch break. I enjoy the info you present here and can’t wait to take a look when I get home. I’m amazed at how quick your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyhow, fantastic site!

Hi there everyone, it’s my first go to see at this site, and post is truly fruitful in favor of me, keep up posting such articles or reviews.

Spot on with this write-up, I seriously believe this web site needs far more attention. I’ll probably be back again to read more, thanks for the info!

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this. Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

Ищете решение для ремонта? Механизированная штукатурка с mehanizirovannaya-shtukaturka-moscow.ru – это быстро, качественно и без пыли.

Ищете профессионалов для механизированной штукатурки стен в Москве? Обратитесь к нам на сайт mehanizirovannaya-shtukaturka-moscow.ru! Мы предлагаем услуги по машинной штукатурке стен любой сложности и площади, а также гарантируем быстрое и качественное выполнение работ.

Hi, after reading this awesome piece of writing i am also cheerful to share my knowledge here with friends.

поставка строительных материалов фирмы

снабжение объектов москва

Ищете надежного подрядчика для устройства стяжки пола в Москве? Обращайтесь к нам на сайт styazhka-pola24.ru! Мы предлагаем услуги по залитию стяжки пола любой сложности и площади, а также гарантируем быстрое и качественное выполнение работ.

Hi there, just wanted to mention, I enjoyed this article. It was practical. Keep on posting!

Awesome blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple adjustements would really make my blog shine. Please let me know where you got your design. Kudos

Howdy! Do you know if they make any plugins to help with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good gains. If you know of any please share. Thank you!

Hey There. I found your blog using msn. This is an extremely well written article. I will be sure to bookmark it and come back to read more of your useful information. Thanks for the post. I will definitely comeback.

Hello there! This is my 1st comment here so I just wanted to give a quick shout out and tell you I truly enjoy reading through your articles. Can you suggest any other blogs/websites/forums that deal with the same subjects? Thanks a ton!

Hey just wanted to give you a quick heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different internet browsers and both show the same results.

Excellent, what a blog it is! This webpage provides helpful information to us, keep it up.

I love what you guys are up too. This sort of clever work and exposure! Keep up the superb works guys I’ve incorporated you guys to blogroll.

Heya i’m for the primary time here. I came across this board and I in finding It truly useful & it helped me out a lot. I hope to provide something back and help others like you helped me.

I like it when individuals come together and share views. Great blog, keep it up!

Everything is very open with a clear description of the issues. It was really informative. Your website is extremely helpful. Thank you for sharing!

If you wish for to get much from this piece of writing then you have to apply such strategies to your won webpage.

Im not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back later. Cheers

Добро пожаловать на сайт онлайн казино, мы предлагаем уникальный опыт для любителей азартных игр.

I go to see each day some web sites and information sites to read articles or reviews, but this webpage gives quality based content.

Howdy would you mind letting me know which webhost you’re working with? I’ve loaded your blog in 3 completely different web browsers and I must say this blog loads a lot quicker then most. Can you suggest a good internet hosting provider at a reasonable price? Cheers, I appreciate it!

I have been surfing online more than three hours these days, yet I never found any fascinating article like yours. It’s pretty value enough for me. In my opinion, if all webmasters and bloggers made just right content as you did, the net will probably be much more useful than ever before.

Hey there! Would you mind if I share your blog with my facebook group? There’s a lot of people that I think would really enjoy your content. Please let me know. Cheers

After checking out a few of the blog posts on your website, I honestly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Take a look at my web site as well and let me know how you feel.

I like the valuable information you supply for your articles. I will bookmark your weblog and test again here frequently. I am somewhat certain I will be informed many new stuff right here! Good luck for the following!

Thanks to my father who told me about this weblog, this weblog is truly awesome.

Онлайн казино радует своих посетителей более чем двумя тысячами увлекательных игр от ведущих разработчиков.

Hi there to every one, as I am actually keen of reading this webpage’s post to be updated regularly. It includes nice information.

I couldn’t resist commenting. Perfectly written!

What’s Happening i’m new to this, I stumbled upon this I have found It positively helpful and it has helped me out loads. I hope to give a contribution & aid other users like its helped me. Good job.

Thank you, I have recently been searching for information approximately this topic for ages and yours is the best I have found out so far. However, what about the conclusion? Are you positive concerning the source?

Hello, just wanted to mention, I enjoyed this post. It was practical. Keep on posting!

Hi to every body, it’s my first pay a visit of this weblog; this weblog contains awesome and truly good information for readers.

Woah! I’m really loving the template/theme of this website. It’s simple, yet effective. A lot of times it’s difficult to get that “perfect balance” between superb usability and visual appearance. I must say that you’ve done a excellent job with this. Additionally, the blog loads extremely fast for me on Opera. Superb Blog!

It’s remarkable to visit this web site and reading the views of all friends concerning this post, while I am also keen of getting knowledge.

Thanks in favor of sharing such a nice opinion, article is nice, thats why i have read it completely

Hi all, here every one is sharing such experience, so it’s nice to read this blog, and I used to pay a visit this blog everyday.

Hi, i feel that i saw you visited my web site so i got here to go back the prefer?.I am trying to in finding things to improve my site!I assume its good enough to use some of your ideas!!

I like the valuable information you provide in your articles. I will bookmark your weblog and check again here frequently. I am quite certain I will learn many new stuff right here! Good luck for the next!

Appreciate the recommendation. Will try it out.

Thank you for some other magnificent article. Where else may anyone get that kind of information in such a perfect way of writing? I have a presentation next week, and I am at the look for such information.

Wow, that’s what I was looking for, what a data! present here at this blog, thanks admin of this website.

If some one needs to be updated with newest technologies afterward he must be go to see this web site and be up to date everyday.

Hi there! I could have sworn I’ve been to this web site before but after going through a few of the posts I realized it’s new to me. Anyhow, I’m definitely happy I found it and I’ll be bookmarking it and checking back regularly!

Nice replies in return of this question with solid arguments and explaining all regarding that.

I simply could not depart your web site prior to suggesting that I really enjoyed the standard information a person supply in your visitors? Is going to be back ceaselessly in order to check out new posts

I loved as much as you will receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get bought an edginess over that you wish be delivering the following. unwell unquestionably come further formerly again since exactly the same nearly a lot often inside case you shield this increase.

Hi it’s me, I am also visiting this web site daily, this site is actually pleasant and the viewers are really sharing nice thoughts.

whoah this blog is great i love reading your articles. Stay up the good work! You recognize, many people are hunting around for this info, you can help them greatly.

Wow! This blog looks exactly like my old one! It’s on a completely different topic but it has pretty much the same layout and design. Great choice of colors!

I was recommended this blog by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my difficulty. You are amazing! Thanks!

Undeniably consider that that you stated. Your favourite justification appeared to be at the internet the simplest thing to consider of. I say to you, I definitely get irked at the same time as other people consider concerns that they plainly do not recognize about. You controlled to hit the nail upon the top as well as defined out the whole thing with no need side effect , folks can take a signal. Will likely be back to get more. Thank you

Hi there, after reading this awesome piece of writing i am too glad to share my familiarity here with friends.

I constantly spent my half an hour to read this website’s posts daily along with a cup of coffee.

Quality articles is the key to attract the viewers to visit the site, that’s what this website is providing.

It’s remarkable in favor of me to have a web site, which is valuable in favor of my knowledge. thanks admin

Thank you a bunch for sharing this with all people you really recognise what you are talking approximately! Bookmarked. Please also discuss with my web site =). We could have a link exchange contract among us

We are a group of volunteers and starting a new scheme in our community. Your site provided us with valuable information to work on. You have done an impressive job and our whole community will be grateful to you.

Amazing blog! Do you have any hints for aspiring writers? I’m planning to start my own website soon but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m totally confused .. Any suggestions? Many thanks!

Whoa! This blog looks exactly like my old one! It’s on a entirely different topic but it has pretty much the same layout and design. Outstanding choice of colors!

Hi there! This is my first visit to your blog! We are a collection of volunteers and starting a new initiative in a community in the same niche. Your blog provided us useful information to work on. You have done a marvellous job!

Hi i am kavin, its my first time to commenting anywhere, when i read this piece of writing i thought i could also make comment due to this brilliant piece of writing.

continuously i used to read smaller posts which also clear their motive, and that is also happening with this piece of writing which I am reading here.

With havin so much content and articles do you ever run into any problems of plagorism or copyright violation? My site has a lot of exclusive content I’ve either created myself or outsourced but it looks like a lot of it is popping it up all over the web without my authorization. Do you know any techniques to help protect against content from being ripped off? I’d truly appreciate it.

This is a good tip especially to those new to the blogosphere. Brief but very accurate information Many thanks for sharing this one. A must read article!

I don’t even know the way I stopped up here, however I assumed this publish was good. I don’t understand who you’re however definitely you are going to a famous blogger for those who are not already. Cheers!

Simply want to say your article is as astonishing. The clearness for your submit is simply excellent and i can think you are a professional in this subject. Well together with your permission allow me to seize your RSS feed to stay up to date with approaching post. Thank you one million and please keep up the rewarding work.

It’s nearly impossible to find knowledgeable people for this topic, but you sound like you know what you’re talking about! Thanks

Your article gave me a lot of inspiration, I hope you can explain your point of view in more detail, because I have some doubts, thank you.

Wow, that’s what I was searching for, what a information! present here at this blog, thanks admin of this website.

This text is priceless. Where can I find out more?

I have been surfing online more than three hours lately, yet I never found any interesting article like yours. It’s pretty value enough for me. Personally, if all site owners and bloggers made just right content as you did, the net shall be much more useful than ever before.

whoah this blog is fantastic i love reading your articles. Stay up the good work! You realize, a lot of people are hunting around for this info, you can help them greatly.

hey there and thank you for your information I’ve definitely picked up anything new from right here. I did however expertise some technical issues using this web site, since I experienced to reload the web site many times previous to I could get it to load properly. I had been wondering if your hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and can damage your quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your respective intriguing content. Make sure you update this again soon.

Hello! I’ve been following your weblog for a while now and finally got the bravery to go ahead and give you a shout out from Houston Tx! Just wanted to tell you keep up the excellent job!

Pretty nice post. I just stumbled upon your blog and wanted to say that I have really enjoyed browsing your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!

Hey there would you mind letting me know which hosting company you’re working with? I’ve loaded your blog in 3 completely different web browsers and I must say this blog loads a lot quicker then most. Can you suggest a good web hosting provider at a honest price? Many thanks, I appreciate it!

Hi, I do believe this is an excellent blog. I stumbledupon it 😉 I am going to come back once again since I book marked it. Money and freedom is the best way to change, may you be rich and continue to help other people.

It’s great that you are getting ideas from this piece of writing as well as from our argument made here.

Hey exceptional blog! Does running a blog similar to this take a lot of work? I have very little expertise in programming but I was hoping to start my own blog soon. Anyways, if you have any recommendations or tips for new blog owners please share. I know this is off topic but I just had to ask. Appreciate it!

You’re so awesome! I don’t think I’ve read anything like this before. So great to find someone with a few original thoughts on this subject. Really.. thanks for starting this up. This website is something that is needed on the web, someone with a little originality!

What’s up to all, it’s really a pleasant for me to pay a visit this site, it contains valuable Information.

Hello! This is kind of off topic but I need some help from an established blog. Is it tough to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about creating my own but I’m not sure where to start. Do you have any points or suggestions? Appreciate it

Excellent post. I’m dealing with a few of these issues as well..

Quality articles is the important to attract the viewers to pay a visit the website, that’s what this site is providing.

Today, I went to the beachfront with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

I visited several web sites but the audio quality for audio songs present at this website is really excellent.

Hurrah! At last I got a blog from where I can really get helpful information regarding my study and knowledge.

hey there and thank you for your information I’ve definitely picked up anything new from right here. I did however expertise some technical issues using this web site, since I experienced to reload the site a lot of times previous to I could get it to load properly. I had been wondering if your web hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your respective interesting content. Make sure you update this again soon.

Hi my family member! I want to say that this article is awesome, great written and come with almost all important infos. I’d like to peer more posts like this .

I’ve been exploring for a little bit for any high-quality articles or blog posts in this kind of space . Exploring in Yahoo I finally stumbled upon this site. Reading this info So i’m glad to exhibit that I have a very good uncanny feeling I came upon exactly what I needed. I so much definitely will make certain to don?t fail to remember this web site and give it a look on a constant basis.

Nice post. I learn something new and challenging on sites I stumbleupon every day. It will always be exciting to read content from other writers and practice a little something from their websites.

Your style is very unique compared to other people I have read stuff from. Thank you for posting when you have the opportunity, Guess I will just bookmark this site.

First off I want to say wonderful blog! I had a quick question in which I’d like to ask if you don’t mind. I was curious to know how you center yourself and clear your thoughts before writing. I have had a hard time clearing my mind in getting my thoughts out. I do enjoy writing but it just seems like the first 10 to 15 minutes are usually wasted just trying to figure out how to begin. Any suggestions or tips? Appreciate it!

Very good site you have here but I was wanting to know if you knew of any user discussion forums that cover the same topics talked about in this article? I’d really love to be a part of online community where I can get responses from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Thanks a lot!

you are in point of fact a good webmaster. The web site loading velocity is incredible. It kind of feels that you are doing any unique trick. Also, The contents are masterpiece. you have performed a wonderful task in this topic!

Hello there! I know this is kinda off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

Pretty great post. I simply stumbled upon your blog and wanted to mention that I have really enjoyed browsing your blog posts. In any case I’ll be subscribing in your feed and I am hoping you write again soon!

Thanks for sharing your thoughts on %meta_keyword%. Regards

Thanks for your personal marvelous posting! I genuinely enjoyed reading it, you might be a great author.I will be sure to bookmark your blog and definitely will come back in the foreseeable future. I want to encourage one to continue your great job, have a nice afternoon!

I’m gone to inform my little brother, that he should also go to see this weblog on regular basis to take updated from most up-to-date gossip.

Hi there, I enjoy reading all of your post. I like to write a little comment to support you.

I am regular reader, how are you everybody? This post posted at this site is in fact pleasant.

Heya i’m for the first time here. I came across this board and I find It truly useful & it helped me out a lot. I hope to give something back and help others like you helped me.

Inspiring quest there. What occurred after? Thanks!

Does your site have a contact page? I’m having a tough time locating it but, I’d like to send you an e-mail. I’ve got some suggestions for your blog you might be interested in hearing. Either way, great website and I look forward to seeing it expand over time.

Nice post. I learn something new and challenging on blogs I stumbleupon everyday. It will always be exciting to read content from other writers and practice a little something from their websites.

Way cool! Some very valid points! I appreciate you writing this post and also the rest of the site is extremely good.

I don’t even know how I ended up here, but I thought this post was good. I don’t know who you are but definitely you are going to a famous blogger if you are not already 😉 Cheers!

Hey! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no data backup. Do you have any solutions to protect against hackers?

Why users still use to read news papers when in this technological world all is available on net?

Элитный мужской эротический массаж Москва телефон

I was recommended this website by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my difficulty. You are wonderful! Thanks!

Superb website you have here but I was curious about if you knew of any community forums that cover the same topics talked about in this article? I’d really love to be a part of group where I can get suggestions from other knowledgeable individuals that share the same interest. If you have any recommendations, please let me know. Appreciate it!

When someone writes an article he/she keeps the plan of a user in his/her mind that how a user can understand it. So that’s why this post is great. Thanks!

Hey there, You have performed an excellent job. I will definitely digg it and individually recommend to my friends. I am sure they will be benefited from this web site.

I am curious to find out what blog system you are utilizing? I’m experiencing some minor security problems with my latest website and I would like to find something more safe. Do you have any solutions?

You can definitely see your enthusiasm in the article you write. The world hopes for more passionate writers like you who aren’t afraid to mention how they believe. All the time go after your heart.

Very nice article. I certainly love this website. Continue the good work!

Simply want to say your article is as surprising. The clearness in your post is simply excellent and i can assume you are an expert on this subject. Well with your permission allow me to grab your RSS feed to keep up to date with forthcoming post. Thanks a million and please continue the rewarding work.

I think this is one of the most significant information for me. And i’m glad reading your article. But wanna remark on few general things, The site style is great, the articles is really nice : D. Good job, cheers

Your way of describing all in this post is truly pleasant, all can effortlessly understand it, Thanks a lot.

Nice post. I learn something new and challenging on sites I stumbleupon everyday. It will always be helpful to read content from other writers and practice a little something from their sites.

Hello there! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

Thank you a bunch for sharing this with all people you really realize what you are talking approximately! Bookmarked. Please also seek advice from my site =). We will have a link exchange contract among us

Hi mates, how is all, and what you desire to say about this article, in my view its in fact remarkable in favor of me.

Hurrah! At last I got a webpage from where I know how to actually take helpful information regarding my study and knowledge.

Every weekend i used to visit this website, because i want enjoyment, as this this site conations actually good funny stuff too.

I like it when individuals come together and share views. Great website, continue the good work!

You really make it seem so easy with your presentation but I find this topic to be really something which I think I would never understand. It seems too complicated and very broad for me. I am looking forward for your next post, I will try to get the hang of it!

I’d like to find out more? I’d care to find out more details.

My spouse and I stumbled over here from a different web page and thought I might check things out. I like what I see so now i’m following you. Look forward to finding out about your web page yet again.

Way cool! Some very valid points! I appreciate you writing this article and the rest of the site is also very good.

My spouse and I stumbled over here different page and thought I might as well check things out. I like what I see so now i’m following you. Look forward to going over your web page again.

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! By the way, how can we communicate?

What’s up, I desire to subscribe for this blog to take latest updates, so where can i do it please assist.

Great beat ! I wish to apprentice while you amend your web site, how can i subscribe for a blog site? The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear concept

This information is invaluable. Where can I find out more?

I have been surfing online more than 2 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. Personally, if all webmasters and bloggers made good content as you did, the internet will be much more useful than ever before.

Wow, that’s what I was looking for, what a information! present here at this website, thanks admin of this site.

Greate article. Keep writing such kind of information on your blog. Im really impressed by your blog.

Your style is so unique compared to other people I have read stuff from. Thanks for posting when you have the opportunity, Guess I will just bookmark this site.

Greate pieces. Keep writing such kind of information on your page. Im really impressed by your blog.

Hello there, You have performed a fantastic job. I will definitely digg it and individually recommend to my friends. I am sure they will be benefited from this site.

Hi mates, nice post and good arguments commented here, I am truly enjoying by these.

This is my first time pay a visit at here and i am truly impressed to read all at one place.

I couldn’t resist commenting. Well written!

I got this web site from my pal who informed me concerning this web site and now this time I am visiting this web site and reading very informative articles at this place.

As the admin of this website is working, no hesitation very rapidly it will be well-known, due to its quality contents.

Everything is very open with a clear description of the issues. It was really informative. Your website is very helpful. Thank you for sharing!

whoah this blog is fantastic i love reading your articles. Stay up the good work! You know, many individuals are searching around for this info, you can help them greatly.

Thank you, I have recently been searching for information approximately this topic for ages and yours is the best I have came upon so far. However, what about the conclusion? Are you sure concerning the source?

It’s a shame you don’t have a donate button! I’d without a doubt donate to this excellent blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to fresh updates and will talk about this blog with my Facebook group. Chat soon!

Simply wish to say your article is as astonishing. The clearness in your post is simply cool and i can assume you are an expert on this subject. Well with your permission allow me to grab your RSS feed to keep up to date with forthcoming post. Thanks a million and please continue the rewarding work.

I believe what you postedwrotethink what you postedwrotesaidbelieve what you postedwrotesaidthink what you postedwroteWhat you postedwrotesaid was very logicala bunch of sense. But, what about this?consider this, what if you were to write a killer headlinetitle?content?typed a catchier title? I ain’t saying your content isn’t good.ain’t saying your content isn’t gooddon’t want to tell you how to run your blog, but what if you added a titleheadlinetitle that grabbed a person’s attention?maybe get people’s attention?want more? I mean %BLOG_TITLE% is a little vanilla. You could peek at Yahoo’s home page and see how they createwrite news headlines to get viewers interested. You might add a related video or a pic or two to get readers interested about what you’ve written. Just my opinion, it could bring your postsblog a little livelier.

Hello very nice website!! Guy .. Beautiful .. Superb .. I will bookmark your website and take the feeds also? I am glad to seek out so many useful information here in the publish, we need develop more strategies in this regard, thank you for sharing. . . . . .

Amazing blog! Do you have any suggestions for aspiring writers? I’m planning to start my own website soon but I’m a little lost on everything. Would you advise starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m totally confused .. Any ideas? Thank you!

Excellent post. I was checking continuously this blog and I am impressed! Very useful information specially the last part 🙂 I care for such info a lot. I was seeking this particular info for a long time. Thank you and good luck.

all the time i used to read smaller posts which also clear their motive, and that is also happening with this post which I am reading at this time.

This is a topic that is close to my heart… Many thanks! Where are your contact details though?

Hi! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing a few months of hard work due to no backup. Do you have any solutions to protect against hackers?

I have fun with, lead to I found exactly what I used to be taking a look for. You have ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

This text is invaluable. Where can I find out more?

Hello there, You have performed a great job. I will definitely digg it and for my part recommend to my friends. I am sure they will be benefited from this web site.

I enjoy what you guys are usually up too. This type of clever work and coverage! Keep up the amazing works guys I’ve you guys to my blogroll.

Ahaa, its pleasant conversation about this post here at this blog, I have read all that, so now me also commenting here.

Thanks to my father who informed me about this weblog, this blog is really remarkable.

This is my first time visit at here and i am really impressed to read all at alone place.

Thanks for finally writing about > %blog_title% < Liked it!

Hi there, I found your blog via Google even as searching for a similar matter, your web site got here up, it looks good. I have bookmarked it in my google bookmarks.

I know this if off topic but I’m looking into starting my own blog and was wondering what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet savvy so I’m not 100% sure. Any tips or advice would be greatly appreciated. Cheers

It is perfect time to make a few plans for the future and it is time to be happy. I have read this publish and if I may just I want to suggest you few fascinating things or suggestions. Perhaps you could write next articles relating to this article. I wish to read more things approximately it!

Greetings! Quick question that’s entirely off topic. Do you know how to make your site mobile friendly? My site looks weird when viewing from my iphone 4. I’m trying to find a theme or plugin that might be able to correct this problem. If you have any suggestions, please share. Appreciate it!

Helpful info. Fortunate me I found your web site accidentally, and I am surprised why this twist of fate did not came about in advance! I bookmarked it.

Way cool! Some very valid points! I appreciate you writing this post and the rest of the site is very good.

Ahaa, its pleasant discussion concerning this article here at this blog, I have read all that, so now me also commenting here.

Great post. I’m going through some of these issues as well..

Have you ever considered about including a little bit more than just your articles? I mean, what you say is fundamental and all. However just imagine if you added some great photos or video clips to give your posts more, “pop”! Your content is excellent but with images and clips, this site could undeniably be one of the very best in its niche. Wonderful blog!

Hi mates, its great post about educationand fully explained, keep it up all the time.

This article will help the internet people for building up new weblog or even a blog from start to end.

Hello there! This post couldn’t be written any better! Reading through this post reminds me of my previous roommate! He always kept talking about this. I am going to forward this article to him. Pretty sure he’ll have a good read. Many thanks for sharing!

Hello there, simply became aware of your blog through Google, and found that it is really informative. I’m gonna watch out for brussels. I will appreciate in case you continue this in future. Lots of other people will probably be benefited from your writing. Cheers!

I got this web site from my friend who told me about this website and now this time I am visiting this web site and reading very informative posts at this place.

Hiya very nice website!! Guy .. Beautiful .. Superb .. I will bookmark your blog and take the feeds also? I am glad to seek out so many useful information here in the publish, we need develop more strategies in this regard, thank you for sharing. . . . . .

Hiya very nice blog!! Guy .. Beautiful .. Superb .. I will bookmark your web site and take the feeds also? I am glad to find numerous useful information here in the post, we need develop more strategies in this regard, thank you for sharing. . . . . .

Thank you for any other fantastic article. Where else may anyone get that kind of information in such a perfect approach of writing? I have a presentation next week, and I am at the look for such information.

Someone necessarily lend a hand to make significantly articles I might state. This is the first time I frequented your web page and to this point? I amazed with the research you made to create this actual publish amazing. Great activity!

Hi there! Do you use Twitter? I’d like to follow you if that would be ok. I’m undoubtedly enjoying your blog and look forward to new updates.

Hi, I do believe this is an excellent blog. I stumbledupon it 😉 I will come back once again since I bookmarked it. Money and freedom is the best way to change, may you be rich and continue to help other people.

Good day! I know this is kinda off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

Great post.

I feel this is one of the such a lot significant information for me. And i’m satisfied reading your article. However wanna remark on few general things, The site taste is great, the articles is actually excellent : D. Just right activity, cheers

Thank you for sharing your info. I truly appreciate your efforts and I am waiting for your next post thank you once again.

This is my first time visit at here and i am in fact impressed to read all at one place.

I love what you guys are up too. This type of clever work and coverage! Keep up the very good works guys I’ve incorporated you guys to our blogroll.

Hello there, just became aware of your blog through Google, and found that it is really informative. I’m gonna watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Magnificent beat ! I wish to apprentice at the same time as you amend your site, how can i subscribe for a blog web site? The account aided me a applicable deal. I were tiny bit familiar of this your broadcast provided bright transparent concept

Hey terrific blog! Does running a blog like this take a massive amount work? I have no expertise in programming but I was hoping to start my own blog soon. Anyways, if you have any suggestions or tips for new blog owners please share. I know this is off topic but I just needed to ask. Kudos!

Hurrah! After all I got a weblog from where I be able to actually get helpful data regarding my study and knowledge.

This is very interesting, You are a very skilled blogger. I have joined your feed and look forward to seeking more of your fantastic post. Also, I have shared your site in my social networks!

This is the right web site for anyone who would like to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want toHaHa). You definitely put a new spin on a topic that’s been written about for years. Excellent stuff, just excellent!

Hey there! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

Good day! I could have sworn I’ve been to this site before but after reading through some of the post I realized it’s new to me. Nonetheless, I’m definitely happy I found it and I’ll be bookmarking and checking back often!

Thanks for your personal marvelous posting! I truly enjoyed reading it, you will be a great author. I will always bookmark your blog and definitely will come back later in life. I want to encourage you to definitely continue your great posts, have a nice day!

This piece of writing will help the internet viewers for building up new website or even a blog from start to end.

Hi there, after reading this awesome piece of writing i am too happy to share my experience here with friends.

Hi mates, how is all, and what you want to say about this article, in my view its in fact remarkable designed for me.

This blog was… how do I say it? Relevant!! Finally I have found something that helped me. Appreciate it!

I’m now not positive where you are getting your info, however good topic. I needs to spend a while learning more or understanding more. Thank you for great information I used to be in search of this information for my mission.

Thanks for ones marvelous posting! I genuinely enjoyed reading it, you could be a great author.I will be sure to bookmark your blog and definitely will come back down the road. I want to encourage one to continue your great posts, have a nice morning!

Very nice article, just what I needed.

Hey! This post couldn’t be written any better! Reading this post reminds me of my good old room mate! He always kept talking about this. I will forward this page to him. Pretty sure he will have a good read. Thank you for sharing!

Every weekend i used to go to see this website, because i want enjoyment, as this this website conations in fact nice funny data too.

I visited several web pages except the audio quality for audio songs current at this website is really marvelous.

Hmm it seems like your site ate my first comment (it was extremely long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog blogger but I’m still new to the whole thing. Do you have any suggestions for beginner blog writers? I’d genuinely appreciate it.

Hi! I could have sworn I’ve been to this site before but after browsing through a few of the posts I realized it’s new to me. Anyways, I’m definitely pleased I discovered it and I’ll be bookmarking it and checking back regularly!

What’s up i am kavin, its my first time to commenting anywhere, when i read this article i thought i could also make comment due to this sensible article.

Hello there, You have performed a fantastic job. I will definitely digg it and in my opinion recommend to my friends. I am sure they will be benefited from this site.

Hey! I realize this is kind of off-topic but I had to ask. Does running a well-established blog like yours take a massive amount work? I’m completely new to writing a blog but I do write in my diary on a daily basis. I’d like to start a blog so I can share my experience and thoughts online. Please let me know if you have any suggestions or tips for new aspiring bloggers. Appreciate it!

I’m gone to tell my little brother, that he should also visit this weblog on regular basis to get updated from most recent reports.

Hi there to every body, it’s my first go to see of this website; this weblog contains remarkable and actually good stuff in favor of readers.

No matter if some one searches for his essential thing, thus he/she wants to be available that in detail, thus that thing is maintained over here.

I am really loving the theme/design of your weblog. Do you ever run into any internet browser compatibility problems? A number of my blog audience have complained about my website not operating correctly in Explorer but looks great in Safari. Do you have any tips to help fix this issue?

Hey there! Would you mind if I share your blog with my facebook group? There’s a lot of people that I think would really enjoy your content. Please let me know. Thank you

First off I want to say wonderful blog! I had a quick question that I’d like to ask if you don’t mind. I was curious to know how you center yourself and clear your thoughts before writing. I have had a difficult time clearing my mind in getting my thoughts out. I do enjoy writing but it just seems like the first 10 to 15 minutes are generally wasted just trying to figure out how to begin. Any suggestions or tips? Thanks!

где купить справку

Someone necessarily lend a hand to make seriously articles I would state. This is the first time I frequented your web page and so far? I amazed with the research you made to create this actual post incredible. Great activity!

Do you have a spam issue on this website; I also am a blogger, and I was wanting to know your situation; many of us have created some nice methods and we are looking to swap methods with other folks, be sure to shoot me an e-mail if interested.

Helpful info. Fortunate me I found your site by chance, and I am stunned why this coincidence did not came about in advance! I bookmarked it.

It is appropriate time to make a few plans for the future and it is time to be happy. I have read this publish and if I may just I wish to suggest you few fascinating things or advice. Perhaps you could write next articles relating to this article. I wish to read more things approximately it!

An intriguing discussion is worth comment. I believe that you ought to write more on this topic, it might not be a taboo subject but usually people don’t speak about such topics. To the next! All the best!!

медицинская справка 2023

медицинская справка

справки

It is perfect time to make a few plans for the longer term and it is time to be happy. I have read this publish and if I may just I wish to recommend you few fascinating things or suggestions. Perhaps you could write next articles referring to this article. I wish to read more things approximately it!

I am curious to find out what blog system you are utilizing? I’m experiencing some minor security problems with my latest site and I would like to find something more risk-free. Do you have any suggestions?

I have been examinating out some of your posts and i must say pretty good stuff.I will surely bookmark your site.Also visit my web site :: kebe.topI enjoy looking through an article that can make men and women think.Also, thank you for permitting me to comment!

It’s appropriate time to make some plans for the long run and it’s time to be happy. I have read this publish and if I may I desire to counsel you some fascinating issues or advice. Maybe you can write subsequent articles referring to this article. I desire to learn even more issues about it!

Thank you Logan! I learn more from you in 30 min then I learn from the governments media releases in five days. I, for one, appreciate you so much!

I have to agree that those who could benefit the most AND need it the most are having to wait for direct deposit the longest. I am in this boat.

Lots of broken examples. But I bet the good examples outnumber the broken ones 1,000:1!

Amazing 80+ million have gotten stimulus checks. Add on unemployment benefits, PPP loans, and no wonder why it’s back to good times in the stock market.

Keep the faith! The PPP is huge. I can’t believe so much money is being given . Surely, the country will open up within 8 weeks.

Keep the faith!

Sam