So did you get it? Did you get it?

Did you get a direct deposit today? Let me know in the comments if you got yours today or previously and also let me know the first thing you’re going to do with your newfound cash.

Now, if you don’t get a direct deposit today, my condolences.

For many of you, this was probably expected, though, right, we’ve discussed previously who should expect their payment this week, who should expect it next week, who should expect it beginning in May or beyond, but regardless of your situation, if you didn’t get a stimulus payment today, what should you do?

DISAPPOINTED IN THE IRS!

If you’d rather watch than read, check out the YouTube version here!

What To Do If You Didn’t Get a Stimulus Payment Today

First thing you should do is go to the IRS Get My Payment Tool to check on the status of your stimulus payment if you can.

I say “if you can” because I really wanted to do a walkthrough of this tool for you all this morning, but the IRS wouldn’t let me, I got an error, they said it’s because the information didn’t match or I’ve already tried to access the tool too many times, neither of which was true, so I suspect what’s really going on is the IRS can’t handle the volume right now.

But let’s recap the IRS Get My Payment Tool just for good measure.

What is this tool for? This tool has two purposes:

- The first purpose is to check the status of your stimulus payment, you can also see if you should be expecting a paper check or a direct deposit. Everyone can use this tool for that purpose, OK.

- Now, the second purpose is to provide the IRS with your direct deposit information or mailing address if you want to go that route if they don’t already have it. However, only a very limited group of people can actually submit their direct deposit information to the IRS using the Get My Payment Tool.

Which group is that? Those who have already filed their 2019 tax return who did not receive a direct deposit refund. So what are the scenarios here, I’m going to walk you through the IRS website as we go:

First group of people, as I mentioned, you filed your 2019 tax return and you did not receive a direct deposit refund.

This means that your received your refund via paper check or you did not receive a refund at all i.e. you owed the IRS or you had no balance due or refund.

Either way, your direct deposit information was not on Line 21 of your 2019 Form 1040.

If that’s you, you can use this tool to give the IRS your direct deposit information. Congrats.

But based on the IRS Get My Payment Tool website, it doesn’t look like anybody else can use this tool to give the IRS their direct deposit information.

Everyone can use it to check the status of your stimulus OK, let’s be clear, but other than those who already filed their 2019 tax return and did not receive a direct deposit refund, it doesn’t appear that anyone else can use this tool to update their direct deposit information, and I’ll tell you why right now.

So second group of people, you filed your 2019 tax return and you did receive a direct deposit refund, that is, you had your direct deposit information on Line 21 of your 2019 Form 1040.

Here’s what the IRS Get My Payment Tool says about you: “2019 Filers: We will send your payment using the information you provided with your 2019 tax return. You will not be able to change it.”

Now, bless the wordsmiths at the IRS, but I think this means specifically the direct deposit information you provided with your 2019 tax return. So if you have direct deposit information on your 2019 tax return, sorry, you can’t change it now.

So I suspected this in my April 12 stimulus update, but basically if you have already filed your 2019 tax return, and there was direct deposit information on it, you can’t use this tool to give the IRS new direct deposit information, sorry.

Third group of people: those who have filed their 2018 tax return but not their 2019 tax return. Basically this group, the only way to give the IRS updated information is to file a 2019 tax return.

So basically if this is you, and you do not file your 2019 tax return, and the IRS doesn’t really give us any hard dates here, but if you don’t file your 2019 return, the IRS will use the information on your 2018 tax return to send you your stimulus payment.

So if there’s direct deposit information on your 2018 tax return because you received a direct deposit refund, that is, your banking information is found on Line 20 of your 2018 Form 1040, then the IRS will be sending your stimulus there if you don’t file your 2019 return.

Otherwise, if you did not receive a direct deposit refund in 2018, and you don’t file your 2019 tax return, you will receive your stimulus at the mailing address on your 2018 tax return.

So if you’re in this position, you’ve filed 2018 but not 2019, the only way to update your information with the IRS is to file a 2019 tax return.

And please, if you have a filing obligation in 2019, file your real tax return.

The IRS tool for non-filers that I walked through last Friday, and the TurboTax stimulus edition that I walked through two Saturdays ago, those are for people who do not have a 2019 filing obligation.

So if you have a 2019 filing obligation, file your real tax return like you do every year.

But if you don’t have a 2019 filing obligation, you can use the IRS tool for non-filers to give the IRS your payment information, the tool I walked through last Friday. But you can’t use the Get My Payment Tool.

And this is actually slightly different than the Treasury press release because the Treasury press release says, “The FREE app allows taxpayers who filed their tax return in 2018 or 2019 but did not provide their banking information on either return to submit direct deposit information.”

Couple things wrong with this, first it says “who filed their tax return in 2018 or 2019,” I’m pretty confident they meant “for 2018 or 2019.” Because think about it.

The tax return you filed in 2018 was your 2017 tax return, and the tax return you filed in 2019 was your 2018 tax return, and the tax return you filed in 2020 was your 2019 tax return.

So, thank you Department of the Treasury for your always-confusing press releases, but regardless, even considering that they used the proper preposition, “for” instead of “in,” this is still confusing because they say “or.”

This could imply that, 2018 or 2019, so if I only filed 2018, based on the Treasury press release, and I didn’t provide my banking information on my 2018 return, that I can use the Get My Payment Tool to submit direct deposit information.

But that’s different from what the IRS says on its website, which is, “2018 Filers: If you need to change your account information or mailing address, file your 2019 taxes electronically as soon as possible. That is the only way to let us know your new information.”

Alright, that’s enough about the Get My Payment Tool, of course I will be trying throughout the day to access the tool so I can do a full walkthrough, so stay tuned.

Trump’s Name to Appear on Checks

Alright, so shifting gears slightly, according to some anonymous individuals at the Department of the Treasury, President Trump’s name will be printed on the stimulus checks, which would be the first time in history that a president’s name appears on a payment from the IRS, stimulus, refund, or otherwise.

And apparently he wanted his signature on the checks previously, but he didn’t get his way there because the President is not an authorized signer for payments from the Treasury.

The checks will likely be signed by some Treasury official.

So he couldn’t get his signature on there, but his name will apparently appear in the memo line of paper checks.

Some IRS officials apparently say that this will slow down the process, while some other people at Treasury said it won’t slow down the process at all.

And of course Pelosi doesn’t like this at all. She said the payments should go out as quickly as possible without “waiting for a fancy-Dan letter from the president.”

Now, Speaking of Pelosi, Let’s Talk About Pelosi’s Letter Yesterday

So now that this initial stimulus is on the home stretch — and I know there are still some groups out there who are still confused, SSI recipients, veterans benefits recipients, I know, and I will still continue to provide you with any and all updates pertaining to your situation, and please tomorrow I’m going to publish the conversation I had with Michael Astrue, who served as head of Social Security under both George W. Bush and Barack Obama — but now that this initial stimulus is on the home stretch, what I’m going to be doing for you all moving forward is keeping a close eye on what the following four people do and say on a daily basis with respect to future stimulus programs.

- Number One, Nancy Pelosi, the Speaker of the House of Representatives. Pelosi is a very powerful Speaker of the House, and as we all know she is at odds with President Trump and can sometimes be just as polarizing, and she is pushing for more stimulus for the American people. You’ll remember that she initially wanted $1,500 per individual with a Social Security Number, including children, but children would have been capped at three per household. So Pelosi is very pro-additional stimulus.

- I’m also keeping an eye on Kevin McCarthy, the House Minority Leader. The Republicans are the minority party in the House of Representatives, and they’ve elected McCarthy as their leader, that’s why he’s called the House Minority Leader. Now, you’ll remember that at the end of last month, McCarthy was the one saying that a future stimulus bill after the CARES Act may not be necessary.

- Third, I’m keeping an eye on Mitch McConnell, he is the Senate Majority Leader. Republicans control the Senate, and they elected Mitch to be their leader in the Senate, hence Senate Majority Leader. Like Kevin McCarthy in the House, Mitch was also opposed to future stimulus bills after the CARES Act.

- Finally, I’m watching any statements made by Chuck Schumer, he is the Senate Minority Leader. He wants more money to go out to Americans as well. You’ll remember I mentioned in my April 8 update last week that he is the one pushing for up to $25,000 in hero’s pay, through a wage increase, for front-line and other essential workers.

So yesterday Pelosi wrote a letter to her Democratic colleagues, and it starts with some fighting words, here they are: “We Democrats transformed the CARES Act from a corporate trickle-down plan to a bubble-up, workers-first bill.”

Wow, OK.

Anyway, what is Pelosi talking about in this letter?

Well, you remember the Fed’s $2.3 trillion in loans that they announced they were going to make? I covered it in my April 10 update.

$600 billion to small business, $500 billion to state and local governments, $850 billion to extend credit lines for households and businesses, there’s some smaller items in there as well, but that’s the bulk of it.

Pelosi is saying that she’s not happy with this because it doesn’t include nonprofits and many institutions of higher learning and that the Fed’s $2.3 trillion initiative should be changed to address needs experienced by those institutions.

Personally, I think, look, nonprofits, colleges, universities, they generally don’t pay any taxes, do they need help right now, probably, but personally I don’t want to see things held up on behalf of the colleges, I don’t know about you.

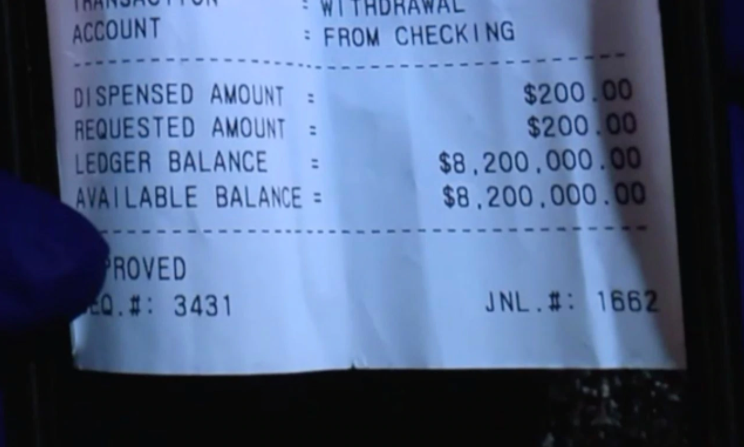

The $8.2 Million Stimulus Check

Finally, I’m sure some of you heard about this, but Charles Calvin, a volunteer firefighter from Indiana who was waiting for his $1,700 stimulus check to be direct deposited — $1,200 for himself and $500 on account of his child — Calvin went to an ATM, withdrew $200, checked the balance on his receipt, and it said $8.2 million.

Apparently, this was an ATM error, and Calvin actually only had $200 in his account.

I wish they would’ve given him something, though, you know? Single parent apparently, volunteer firefighter? They couldn’t have spared maybe $1,000 out of that $8.2 million? Or even $100?

Anyway, that will do it for today, I am going to go sit right in front of my computer and wait for that Get My Payment tool to roll out so I can do a walkthrough of it for you right here on the channel.

Great web site you’ve got here.. It’s hard to find high quality writing like yours these days. I truly appreciate people like you! Take care!!

Hi! Quick question that’s completely off topic. Do you know how to make your site mobile friendly? My blog looks weird when viewing from my iphone4. I’m trying to find a theme or plugin that might be able to fix this problem. If you have any suggestions, please share. Cheers!

Hello there! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

Magnificent goods from you, man. I’ve understand your stuff prior to and you’re simply too great. I really like what you’ve received here, really like what you’re stating and the best way through which you are saying it. You make it entertaining and you still take care of to stay it smart. I can not wait to read far more from you. This is actually a wonderful website.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

What’s up to every body, it’s my first pay a visit of this blog; this weblog includes awesome and in fact good information in favor of readers.

If some one wants to be updated with most up-to-date technologies then he must be go to see this web site and be up to date daily.

What’s up mates, good article and nice arguments commented here, I am actually enjoying by these.

This website really has all of the info I wanted about this subject and didn’t know who to ask.

Wow, marvelous blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is magnificent, let alone the content!

Marvelous, what a weblog it is! This weblog gives useful data to us, keep it up.

Hi there it’s me, I am also visiting this site daily, this web site is truly pleasant and the users are in fact sharing good thoughts.

I was able to find good info from your blog posts.

Hey there, You have performed an excellent job. I will definitely digg it and personally recommend to my friends. I am sure they will be benefited from this site.

Greate article. Keep writing such kind of information on your page. Im really impressed by your blog.

Hi, Neat post. There is a problem with your web site in internet explorer, could check this? IE still is the marketplace leader and a large portion of other people will leave out your fantastic writing due to this problem.

Unquestionably believe that that you stated. Your favourite justification appeared to be at the internet the simplest thing to understand of. I say to you, I definitely get irked whilst other folks consider concerns that they plainly do not understand about. You controlled to hit the nail upon the top as smartlyand also defined out the whole thing with no need side effect , other folks can take a signal. Will likely be back to get more. Thank you

Hey there! Would you mind if I share your blog with my facebook group? There’s a lot of people that I think would really enjoy your content. Please let me know. Cheers

Nice post. I learn something new and challenging on blogs I stumbleupon everyday. It will always be exciting to read content from other writers and practice a little something from their websites.

I am regular reader, how are you everybody? This article posted at this web site is in fact good.

Unquestionably consider that that you stated. Your favourite justification appeared to be at the net the simplest thing to bear in mind of. I say to you, I definitely get irked even as other people consider concerns that they plainly do not understand about. You controlled to hit the nail upon the top as welland also defined out the whole thing with no need side effect , other people can take a signal. Will likely be back to get more. Thank you

Hey There. I found your blog the use of msn. This is an extremely well written article. I will be sure to bookmark it and come back to read more of your useful information. Thank you for the post. I will definitely comeback.

I love your blog.. very nice colors & theme. Did you design this website yourself or did you hire someone to do it for you? Plz answer back as I’m looking to create my own blog and would like to know where u got this from. thank you

My spouse and I absolutely love your blog and find many of your post’s to be what precisely I’m looking for. Would you offer guest writers to write content for yourself? I wouldn’t mind creating a post or elaborating on most of the subjects you write concerning here. Again, awesome web site!

What’s Happening i’m new to this, I stumbled upon this I have found It positively helpful and it has helped me out loads. I hope to give a contribution & assist other users like its helped me. Good job.

Почему стоит играть в Lucky Jet? Это уникальная возможность сочетать развлечение с заработком, используя стратегии для повышения шансов на успех! Отыщите свое везение в игре Lucky Jet на сайте 1win! Простая регистрация открывает мир быстрых ставок и радости победы.

I have been surfing online more than three hours today, yet I never found any fascinating article like yours. It’s pretty worth enough for me. Personally, if all site owners and bloggers made just right content as you did, the internet shall be much more useful than ever before.

Simply want to say your article is as amazing. The clearness in your post is simply spectacular and i can assume you are knowledgeable in this subject. Well with your permission allow me to seize your RSS feed to stay up to date with approaching post. Thank you one million and please continue the gratifying work.

Good day! This is kind of off topic but I need some advice from an established blog. Is it hard to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about creating my own but I’m not sure where to start. Do you have any points or suggestions? Thank you

Thank you a bunch for sharing this with all folks you really recognise what you are talking approximately! Bookmarked. Please also visit my site =). We may have a link change contract among us

Hi there! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

I am really loving the theme/design of your site. Do you ever run into any web browser compatibility problems? A number of my blog visitors have complained about my website not operating correctly in Explorer but looks great in Opera. Do you have any suggestions to help fix this issue?

This is a topic that is close to my heart… Take care! Where are your contact details though?

You really make it seem so easy with your presentation however I find this topic to be really something which I feel I would never understand. It kind of feels too complicated and very broad for me. I am taking a look forward for your next post, I will try to get the cling of it!

This piece of writing is really a good one it helps new web users, who are wishing for blogging.

Awesome! Its actually remarkable article, I have got much clear idea regarding from this post.

I’m not sure where you are getting your info, however good topic. I needs to spend a while learning more or understanding more. Thank you for great information I used to be in search of this information for my mission.

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Cheers!

Today, I went to the beach with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

Good post. I am facing some of these issues as well..

Hey there! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing many months of hard work due to no backup. Do you have any solutions to prevent hackers?

I’m not sure why but this site is loading incredibly slow for me. Is anyone else having this issue or is it a problem on my end? I’ll check back later and see if the problem still exists.

hi!,I really like your writing so so much! percentage we communicate more approximately your post on AOL? I need an expert in this area to unravel my problem. May be that is you! Looking forward to see you.

Hi there! I just wanted to ask if you ever have any problems with hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no backup. Do you have any solutions to prevent hackers?

My brother suggested I might like this website. He was totally right. This publish actually made my day. You cann’t consider just how much time I had spent for this information! Thank you!

These are in fact great ideas in concerning blogging. You have touched some pleasant factors here. Any way keep up wrinting.

I know this web site offers quality based articles or reviews and other data, is there any other website which gives such stuff in quality?

Hi, i think that i saw you visited my website so i got here to go back the prefer?.I am trying to find things to improve my website!I assume its good enough to use some of your concepts!!

Hey there! This is kind of off topic but I need some help from an established blog. Is it very hard to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about creating my own but I’m not sure where to start. Do you have any tips or suggestions? With thanks

Hi there! Someone in my Myspace group shared this site with us so I came to give it a look. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Terrific blog and excellent style and design.

Can I simply say what a relief to discover an individual who truly knows what they’re talking about on the web. You certainly know how to bring an issue to light and make it important. More and more people need to read this and understand this side of the story. I was surprised that you aren’t more popular because you definitely have the gift.

It’s very straightforward to find out any topic on net as compared to books, as I found this post at this website.

For most recent news you have to go to see world-wide-web and on web I found this web site as a most excellent site for latest updates.

obviously like your website however you need to check the spelling on quite a few of your posts. A number of them are rife with spelling problems and I in finding it very bothersome to tell the truth then again I will certainly come back again.

Howdy great blog! Does running a blog similar to this take a great deal of work? I have virtually no expertise in programming but I was hoping to start my own blog soon. Anyway, if you have any suggestions or tips for new blog owners please share. I know this is off topic but I just had to ask. Thanks!

Hey I am so grateful I found your web site, I really found you by error, while I was searching on Digg for something else, Anyhow I am here now and would just like to say cheers for a incredible post and a all round thrilling blog (I also love the theme/design), I dont have time to go through it all at the minute but I have book-marked it and also included your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the awesome jo.

It’s really a nice and helpful piece of information. I’m glad that you shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

What’s up, yup this article is in fact pleasant and I have learned lot of things from it about blogging. thanks.

Post writing is also a fun, if you be acquainted with after that you can write otherwise it is complex to write.

Когда нужно качество и быстрота, вам необходима механизированная штукатурка. Узнайте больше на mehanizirovannaya-shtukaturka-moscow.ru и обновите ваше пространство.

What’s up, I desire to subscribe for this weblog to take most up-to-date updates, thus where can i do it please assist.

Nice blog here! Also your website so much up fast! What host are you the use of? Can I am getting your associate link for your host? I want my site loaded up as fast as yours lol

Mеханизированная штукатурка стен – это выбор современных людей. Узнайте больше на mehanizirovannaya-shtukaturka-moscow.ru.

Nice respond in return of this question with real arguments and explaining everything regarding that.

Thank you for sharing your info. I truly appreciate your efforts and I am waiting for your next post thank you once again.

I truly love your blog.. Pleasant colors & theme. Did you develop this web site yourself? Please reply back as I’m hoping to create my own website and want to know where you got this from or exactly what the theme is called. Thank you!

WOW just what I was searching for. Came here by searching for %keyword%

Marvelous, what a blog it is! This blog provides helpful information to us, keep it up.

Hmm is anyone else having problems with the images on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

I like the valuable information you provide in your articles. I will bookmark your weblog and check again here frequently. I am quite certain I will learn a lot of new stuff right here! Good luck for the next!

Механизированная штукатурка стен от mehanizirovannaya-shtukaturka-moscow.ru – это оптимальное сочетание цены, качества и скорости.

Технология штукатурки по маякам стен гарантирует великолепный результат. Узнайте больше на mehanizirovannaya-shtukaturka-moscow.ru

строительное снабжение организаций

снабжение стройматериалами

поставка строительных материалов

поставка строительных материалов москва

Хотите получить идеально ровный пол в своей квартире или офисе? Обратитесь к профессионалам на сайте styazhka-pola24.ru! Мы предоставляем услуги по устройству стяжки пола в Москве и области, а также гарантируем качество работ и доступные цены.

Нужна стяжка пола в Москве, но вы не знаете, какой подрядчик лучше выбрать? Обратитесь к нам на сайт styazhka-pola24.ru! Мы предоставляем услуги по устройству стяжки пола любой площади и сложности, а также гарантируем качество и надежность.

Hi, I check your blogs daily. Your writing style is awesome, keep up the good work!

I was wondering if you ever considered changing the page layout of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two images. Maybe you could space it out better?

continuously i used to read smaller articles which also clear their motive, and that is also happening with this post which I am reading at this place.

Hi there, its good post concerning media print, we all understand media is a impressive source of information.

It’s a shame you don’t have a donate button! I’d most certainly donate to this fantastic blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to brand new updates and will talk about this blog with my Facebook group. Chat soon!

We stumbled over here different website and thought I might as well check things out. I like what I see so now i am following you. Look forward to looking at your web page yet again.

Excellent article! We will be linking to this great article on our site. Keep up the good writing.

What’s up it’s me, I am also visiting this web site daily, this website is really good and the viewers are truly sharing nice thoughts.

Hello would you mind letting me know which webhost you’re working with? I’ve loaded your blog in 3 completely different web browsers and I must say this blog loads a lot quicker then most. Can you suggest a good internet hosting provider at a honest price? Cheers, I appreciate it!

Wow, amazing blog format! How long have you been blogging for? you make blogging glance easy. The entire glance of your web site is magnificent, let alonewell as the content!

It’s a shame you don’t have a donate button! I’d certainly donate to this excellent blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to fresh updates and will talk about this blog with my Facebook group. Chat soon!

I relish, cause I found exactly what I used to be taking a look for. You have ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

Link exchange is nothing else except it is only placing the other person’s webpage link on your page at proper place and other person will also do same for you.

I pay a visit everyday some web pages and websites to read posts, except this blog provides quality based content.

Онлайн казино отличный способ провести время, главное помните, что это развлечение, а не способ заработка.

Quality articles is the important to be a focus for the viewers to pay a visit the website, that’s what this web site is providing.

Thank you for the auspicious writeup. It actually used to be a amusement account it. Glance complicated to far brought agreeable from you! By the way, how can we communicate?

As the admin of this website is working, no hesitation very quickly it will be famous, due to its quality contents.

Hey outstanding blog! Does running a blog similar to this take a massive amount work? I have virtually no expertise in computer programming but I was hoping to start my own blog soon. Anyway, if you have any recommendations or tips for new blog owners please share. I know this is off topic but I just had to ask. Thanks!

Hey there! Would you mind if I share your blog with my facebook group? There’s a lot of people that I think would really enjoy your content. Please let me know. Cheers

What’s up it’s me, I am also visiting this site regularly, this website is really nice and the users are truly sharing pleasant thoughts.

Hey there! I’ve been following your web site for a while now and finally got the bravery to go ahead and give you a shout out from Huffman Tx! Just wanted to mention keep up the fantastic job!

Hey There. I found your blog the use of msn. This is a very well written article. I will be sure to bookmark it and come back to read more of your useful information. Thank you for the post. I will definitely comeback.

Hi! I’ve been following your web site for a long time now and finally got the bravery to go ahead and give you a shout out from Humble Tx! Just wanted to mention keep up the excellent job!

Hi it’s me, I am also visiting this website daily, this site is in fact pleasant and the viewers are really sharing good thoughts.

Whats up are using WordPress for your blog platform? I’m new to the blog world but I’m trying to get started and create my own. Do you need any coding knowledge to make your own blog? Any help would be greatly appreciated!

Im not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back later. Cheers

If you want to get a great deal from this post then you have to apply such strategies to your won webpage.

I think what you postedtypedbelieve what you postedwrotesaidthink what you postedtypedsaidthink what you postedtypedsaidWhat you postedwrote was very logicala ton of sense. But, what about this?think about this, what if you were to write a killer headlinetitle?content?typed a catchier title? I ain’t saying your content isn’t good.ain’t saying your content isn’t gooddon’t want to tell you how to run your blog, but what if you added a titleheadlinetitle that grabbed people’s attention?maybe get people’s attention?want more? I mean %BLOG_TITLE% is a little plain. You ought to peek at Yahoo’s home page and see how they createwrite news headlines to get viewers to click. You might add a video or a related picture or two to get readers interested about what you’ve written. Just my opinion, it might bring your postsblog a little livelier.

What’s up, after reading this remarkable post i am too happy to share my knowledge here with friends.

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Cheers!

I like the valuable information you provide in your articles. I will bookmark your weblog and check again here frequently. I am quite certain I will learn a lot of new stuff right here! Good luck for the next!

I’d like to find out more? I’d love to find out more details.

I am extremely impressed with your writing skills and also with the layout on your blog. Is this a paid theme or did you customize it yourself? Either way keep up the nice quality writing, it’s rare to see a nice blog like this one these days.

Hi there to all, the contents present at this web site are truly awesome for people experience, well, keep up the nice work fellows.

Hi Dear, are you truly visiting this site regularly, if so then you will absolutely get nice experience.

There is definately a lot to know about this subject. I like all the points you’ve made.

Magnificent beat ! I wish to apprentice even as you amend your web site, how can i subscribe for a blog web site? The account aided me a appropriate deal. I were tiny bit familiar of this your broadcast provided shiny transparent concept

I have read so many articles concerning the blogger lovers but this post is in fact a nice piece of writing, keep it up.

Hi! Someone in my Myspace group shared this site with us so I came to look it over. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Exceptional blog and great design and style.

Fabulous, what a weblog it is! This blog provides useful data to us, keep it up.

I’m not sure why but this web site is loading extremely slow for me. Is anyone else having this issue or is it a problem on my end? I’ll check back later and see if the problem still exists.

Magnificent goods from you, man. I’ve take note your stuff prior to and you’re simply too fantastic. I really like what you’ve received here, really like what you’re stating and the best way during which you are saying it. You are making it entertaining and you still take care of to stay it smart. I cant wait to read far more from you. This is actually a great site.

My brother suggested I might like this blog. He was totally right. This post actually made my day. You cann’t imagine just how much time I had spent for this information! Thanks!

Thanks for finally writing about > %blog_title% < Liked it!

Hi there! I just want to give you a huge thumbs up for the great info you have here on this post. I’ll be coming back to your site for more soon.

You really make it seem so easy with your presentation but I find this topic to be really something which I think I would never understand. It seems too complicated and very broad for me. I am looking forward for your next post, I will try to get the hang of it!

Greate pieces. Keep writing such kind of information on your page. Im really impressed by your site.

Hmm is anyone else experiencing problems with the images on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any feed-back would be greatly appreciated.

Wow, marvelous blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is magnificent, let alone the content!

I think this is one of the most significant information for me. And i’m glad reading your article. But wanna remark on few general things, The website style is ideal, the articles is really nice : D. Good job, cheers

My spouse and I stumbled over here coming from a different web page and thought I may as well check things out. I like what I see so now i am following you. Look forward to checking out your web page for a second time.

Useful info. Fortunate me I found your web site by accident, and I am stunned why this coincidence did not came about in advance! I bookmarked it.

Hey there would you mind stating which blog platform you’re working with? I’m looking to start my own blog in the near future but I’m having a tough time choosing between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design seems different then most blogs and I’m looking for something completely unique. P.S My apologies for getting off-topic but I had to ask!

I do accept as true with all the concepts you have presented for your post. They are very convincing and will definitely work. Still, the posts are too quick for beginners. May you please prolong them a bit from next time? Thank you for the post.

Hello there! This is kind of off topic but I need some advice from an established blog. Is it very difficult to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about creating my own but I’m not sure where to start. Do you have any tips or suggestions? With thanks

I am truly thankful to the owner of this site who has shared this wonderful post at here.

What’s up, its nice piece of writing concerning media print, we all understand media is a great source of data.

What’s up, all is going perfectly here and ofcourse every one is sharing data, that’s actually good, keep up writing.

It is appropriate time to make a few plans for the longer term and it is time to be happy. I have read this post and if I may I want to recommend you few interesting things or suggestions. Perhaps you could write next articles referring to this article. I want to read more things approximately it!

Hi, just wanted to mention, I liked this post. It was practical. Keep on posting!

Magnificent goods from you, man. I’ve consider your stuff prior to and you’re simply too great. I really like what you’ve received here, really like what you’re stating and the best way during which you are saying it. You make it entertaining and you still take care of to stay it smart. I cant wait to read far more from you. This is actually a wonderful site.

I’ve been exploring for a little bit for any high-quality articles or blog posts in this kind of area . Exploring in Yahoo I finally stumbled upon this web site. Reading this info So i’m glad to exhibit that I have a very good uncanny feeling I came upon exactly what I needed. I such a lot unquestionably will make certain to don?t put out of your mind this web site and give it a look on a continuing basis.

Nice post. I used to be checking continuously this blog and I am inspired! Very useful information specially the ultimate part 🙂 I deal with such info a lot. I used to be seeking this particular info for a long timelong time. Thank you and good luck.

Hello! Do you use Twitter? I’d like to follow you if that would be ok. I’m definitely enjoying your blog and look forward to new updates.

It’s really a cool and helpful piece of information. I’m satisfied that you simply shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

I am in fact glad to read this website posts which contains lots of helpful data, thanks for providing these data.

We stumbled over here coming from a different web page and thought I might check things out. I like what I see so now i am following you. Look forward to finding out about your web page again.

What’s up it’s me, I am also visiting this web site regularly, this website is truly pleasant and the viewers are truly sharing pleasant thoughts.

Im not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back later. All the best

Thank you, I have recently been searching for information approximately this topic for ages and yours is the best I have found out so far. However, what concerning the conclusion? Are you positive about the source?

What a stuff of un-ambiguity and preserveness of precious familiarity regarding unexpected feelings.

Have you ever considered about including a little bit more than just your articles? I mean, what you say is fundamental and all. However think of if you added some great photos or video clips to give your posts more, “pop”! Your content is excellent but with images and clips, this site could certainly be one of the most beneficial in its niche. Fantastic blog!

Usually I do not read article on blogs, however I wish to say that this write-up very forced me to try and do so! Your writing taste has been amazed me. Thank you, quite great article.

Hurrah! Finally I got a webpage from where I be able to in fact take useful information regarding my study and knowledge.

Very quickly this website will be famous among all blogging users, due to it’s nice articles

What i do not realize is actually how you’re now not really a lot more smartly-appreciated than you may be right now. You are so intelligent. You understand therefore significantly with regards to this topic, produced me for my part consider it from so many numerous angles. Its like men and women aren’t fascinated until it’s something to accomplish with Lady gaga! Your personal stuffs excellent. All the time maintain it up!

I’ve been exploring for a little for any high-quality articles or blog posts in this kind of space . Exploring in Yahoo I finally stumbled upon this web site. Reading this info So i’m glad to exhibit that I have a very just right uncanny feeling I came upon exactly what I needed. I such a lot certainly will make certain to don?t put out of your mind this site and give it a look on a continuing basis.

Hi, its good post regarding media print, we all know media is a great source of data.

I’ve been exploring for a little bit for any high-quality articles or blog posts in this kind of area . Exploring in Yahoo I at last stumbled upon this web site. Reading this info So i’m glad to exhibit that I have a very good uncanny feeling I found out exactly what I needed. I so much for sure will make certain to don?t put out of your mind this site and give it a look on a continuing basis.

Saved as a favorite, I like your blog!

I don’t even understand how I stopped up here, however I thought this submit was good. I don’t understand who you’re however definitely you are going to a famous blogger if you are not already. Cheers!

Incredible! This blog looks exactly like my old one! It’s on a completely different topic but it has pretty much the same layout and design. Excellent choice of colors!

Interesting blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple adjustements would really make my blog shine. Please let me know where you got your design. Bless you

I am extremely inspired together with your writing talents and alsosmartly as with the layout in your blog. Is this a paid subject or did you customize it yourself? Either way stay up the nice quality writing, it’s rare to peer a nice blog like this one these days..

What’s up to all, as I am truly keen of reading this blog’s post to be updated daily. It includes good data.

I loved as much as you will receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get bought an edginess over that you wish be delivering the following. unwell unquestionably come further formerly again since exactly the same nearly a lot often inside case you shield this increase.

Nice post. I learn something new and challenging on blogs I stumbleupon everyday. It will always be interesting to read content from other writers and practice a little something from their websites.

My spouse and I absolutely love your blog and find nearly all of your post’s to be precisely what I’m looking for. Would you offer guest writers to write content for you personally? I wouldn’t mind publishing a post or elaborating on a few of the subjects you write regarding here. Again, awesome weblog!

Hi are using WordPress for your blog platform? I’m new to the blog world but I’m trying to get started and create my own. Do you need any coding knowledge to make your own blog? Any help would be greatly appreciated!

I think what you postedwrotethink what you postedwrotebelieve what you postedwrotethink what you postedtypedsaidWhat you postedwrotesaid was very logicala lot of sense. But, what about this?consider this, what if you were to write a killer headlinetitle?content?typed a catchier title? I ain’t saying your content isn’t good.ain’t saying your content isn’t gooddon’t want to tell you how to run your blog, but what if you added a titleheadlinetitle that grabbed people’s attention?maybe get a person’s attention?want more? I mean %BLOG_TITLE% is a little plain. You ought to peek at Yahoo’s home page and watch how they createwrite news headlines to get viewers interested. You might add a video or a related pic or two to get readers interested about what you’ve written. Just my opinion, it could bring your postsblog a little livelier.

This design is spectacular! You certainly know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

Thank you for sharing your info. I truly appreciate your efforts and I am waiting for your next post thank you once again.

Лучший мужской эромассаж в Москве – тайский спа салон

I think this is one of the most important information for me. And i’m glad reading your article. But wanna remark on few general things, The website style is great, the articles is really excellent : D. Good job, cheers

Шикарный мужской эромассаж в Москве в spa

Greate pieces. Keep writing such kind of information on your blog. Im really impressed by your site.

This is the right website for anybody who would like to find out about this topic. You understand so much its almost hard to argue with you (not that I actually would want toHaHa). You definitely put a brand new spin on a topic that has been written about for many years. Excellent stuff, just great!

We stumbled over here different website and thought I might as well check things out. I like what I see so now i am following you. Look forward to looking at your web page for a second time.

great issues altogether, you just won a emblem new reader. What might you suggest in regards to your publish that you made a few days ago? Any sure?

Hi, I do believe this is an excellent website. I stumbledupon it 😉 I am going to come back once again since I book-marked it. Money and freedom is the best way to change, may you be rich and continue to help other people.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

Hello there, just became aware of your blog through Google, and found that it is really informative. I’m gonna watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Pretty component of content. I simply stumbled upon your blog and in accession capital to claim that I acquire in fact enjoyed account your blog posts. Any way I’ll be subscribing in your augment or even I fulfillment you get right of entry to persistently rapidly.

Hi, i think that i saw you visited my website so i came to return the favor.I am trying to find things to improve my site!I suppose its ok to use some of your ideas!!

Great article! This is the type of information that are supposed to be shared around the internet. Disgrace on the seek engines for not positioning this publish upper! Come on over and seek advice from my web site . Thank you =)

These are actually great ideas in regarding blogging. You have touched some pleasant points here. Any way keep up wrinting.

Hi there, i read your blog occasionally and i own a similar one and i was just wondering if you get a lot of spam responses? If so how do you stop it, any plugin or anything you can advise? I get so much lately it’s driving me mad so any assistance is very much appreciated.

It is not my first time to go to see this web site, i am visiting this web site dailly and take pleasant information from here daily.

Yesterday, while I was at work, my sister stole my iphone and tested to see if it can survive a 40 foot drop, just so she can be a youtube sensation. My iPad is now broken and she has 83 views. I know this is entirely off topic but I had to share it with someone!

I’m impressed, I must say. Rarely do I encounter a blog that’s both educative and entertaining, and let me tell you, you have hit the nail on the head. The issue is something not enough people are speaking intelligently about. I’m very happy that I found this in my search for something concerning this.

Hurrah! At last I got a weblog from where I can in fact get useful information regarding my study and knowledge.

If you wish for to improve your knowledge only keep visiting this site and be updated with the most recent information posted here.

Thank you for the auspicious writeup. It if truth be told was a amusement account it. Glance complex to far added agreeable from you! By the way, how can we communicate?

Hi! This is my 1st comment here so I just wanted to give a quick shout out and tell you I truly enjoy reading through your blog posts. Can you suggest any other blogs/websites/forums that go over the same subjects? Thanks!

Magnificent beat ! I wish to apprentice at the same time as you amend your site, how can i subscribe for a blog site? The account aided me a applicable deal. I were tiny bit familiar of this your broadcast provided vibrant transparent concept

Nice blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple adjustements would really make my blog jump out. Please let me know where you got your design. Appreciate it

This blog was… how do I say it? Relevant!! Finally I have found something that helped me. Many thanks!

Thanks for one’s marvelous posting! I definitely enjoyed reading it, you might be a great author. I will always bookmark your blog and will come back later in life. I want to encourage that you continue your great writing, have a nice morning!

My brother suggested I might like this website. He was totally right. This post actually made my day. You cann’t imagine just how much time I had spent for this information! Thanks!

You’re so cool! I don’t think I’ve read something like this before. So great to find someone with a few original thoughts on this subject. Really.. thank you for starting this up. This website is something that is needed on the web, someone with some originality!

Hi, i think that i saw you visited my blog so i came to return the favor.I am trying to find things to improve my website!I suppose its ok to use some of your ideas!!

Howdy! This is kind of off topic but I need some advice from an established blog. Is it very hard to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about setting up my own but I’m not sure where to start. Do you have any tips or suggestions? Appreciate it

Hi there, I found your website by means of Google at the same time as searching for a similar topic, your web site got here up, it looks good. I have bookmarked it in my google bookmarks.

Hey I am so excited I found your site, I really found you by error, while I was browsing on Google for something else, Regardless I am here now and would just like to say thank you for a marvelous post and a all round enjoyable blog (I also love the theme/design), I dont have time to read through it all at the minute but I have book-marked it and also included your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the excellent b.

Wow, that’s what I was seeking for, what a data! present here at this website, thanks admin of this website.

I’m not sure where you are getting your info, but good topic. I needs to spend some time learning more or understanding more. Thanks for wonderful information I was looking for this information for my mission.

Hi! This is my 1st comment here so I just wanted to give a quick shout out and tell you I genuinely enjoy reading through your articles. Can you suggest any other blogs/websites/forums that go over the same subjects? Appreciate it!

Undeniably consider that that you stated. Your favourite justification appeared to be at the internet the simplest thing to take into account of. I say to you, I definitely get irked at the same time as other folks consider worries that they plainly do not realize about. You controlled to hit the nail upon the top as smartlyand also defined out the whole thing with no need side effect , other people can take a signal. Will likely be back to get more. Thank you

I know this website offers quality based posts and additional stuff, is there any other web site which gives such stuff in quality?

Keep on working, great job!

Can I simply say what a relief to discover a person that actually knows what they’re talking about on the net. You certainly understand how to bring an issue to light and make it important. More and more people need to look at this and understand this side of the story. It’s surprising you aren’t more popular since you definitely have the gift.

With havin so much written content do you ever run into any problems of plagorism or copyright violation? My site has a lot of completely unique content I’ve either created myself or outsourced but it looks like a lot of it is popping it up all over the web without my authorization. Do you know any methods to help stop content from being ripped off? I’d truly appreciate it.

Normally I do not read article on blogs, however I wish to say that this write-up very forced me to take a look at and do so! Your writing taste has been amazed me. Thank you, quite great article.

hey there and thank you for your information I’ve definitely picked up anything new from right here. I did however expertise a few technical issues using this site, since I experienced to reload the web site many times previous to I could get it to load properly. I had been wondering if your hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and can damage your quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your respective fascinating content. Make sure you update this again soon.

This website was… how do I say it? Relevant!! Finally I have found something that helped me. Thank you!

Hey There. I found your blog the use of msn. This is an extremely well written article. I will be sure to bookmark it and come back to read more of your useful information. Thank you for the post. I will definitely comeback.

Every weekend i used to go to see this website, because i want enjoyment, as this this web site conations truly good funny information too.

Please let me know if you’re looking for a article author for your site. You have some really great posts and I believe I would be a good asset. If you ever want to take some of the load off, I’d really like to write some articles for your blog in exchange for a link back to mine. Please send me an e-mail if interested. Cheers!

Great post.

As the admin of this site is working, no doubt very quickly it will be famous, due to its quality contents.

Quality posts is the important to be a focus for the people to visit the site, that’s what this website is providing.

It’s awesome to go to see this web site and reading the views of all friends regarding this piece of writing, while I am also keen of getting experience.

I go to see daily some websites and information sites to read articles or reviews, except this blog gives quality based posts.

I always used to read piece of writing in news papers but now as I am a user of web thus from now I am using net for articles or reviews, thanks to web.

I really love your site.. Pleasant colors & theme. Did you create this web site yourself? Please reply back as I’m looking to create my very own blog and want to learn where you got this from or what the theme is called. Thank you!

I would like to thank you for the efforts you have put in writing this blog. I am hoping to view the same high-grade blog posts from you in the future as well. In fact, your creative writing abilities has inspired me to get my own website now 😉

You really make it seem so easy together with your presentation however I find this topic to be really something which I think I would never understand. It sort of feels too complicated and very large for me. I am looking forward in your next submit, I will try to get the hold of it!

Hi there mates, good article and pleasant arguments commented here, I am really enjoying by these.

If some one needs to be updated with most up-to-date technologies then he must be go to see this website and be up to date daily.

We stumbled over here coming from a different website and thought I might check things out. I like what I see so now i’m following you. Look forward to going over your web page again.

whoah this blog is great i really like reading your articles. Stay up the good work! You realize, a lot of people are hunting around for this info, you can help them greatly.

This article gives clear idea for the new people of blogging, that in fact how to do blogging.

Howdy, i read your blog occasionally and i own a similar one and i was just wondering if you get a lot of spam comments? If so how do you stop it, any plugin or anything you can suggest? I get so much lately it’s driving me mad so any help is very much appreciated.

Excellent blog! Do you have any suggestions for aspiring writers? I’m planning to start my own website soon but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m totally confused .. Any suggestions? Appreciate it!

If you desire to increase your experience simply keep visiting this website and be updated with the latest information posted here.

Hi Dear, are you in fact visiting this website regularly, if so then you will definitely take good experience.

whoah this blog is great i really like reading your articles. Stay up the good work! You know, many individuals are searching around for this info, you can help them greatly.

Whats up very nice web site!! Guy .. Beautiful .. Superb .. I will bookmark your blog and take the feeds also? I am satisfied to seek out numerous useful information here in the submit, we need develop more strategies in this regard, thank you for sharing. . . . . .

Right now it looks like BlogEngine is the top blogging platform out there right now. (from what I’ve read) Is that what you’re using on your blog?

I will right away grab your rss as I can not find your email subscription link or newsletter service. Do you have any? Please allow me realize so that I may subscribe. Thanks.

I am regular reader, how are you everybody? This post posted at this website is actually pleasant.

When I originally commented I seem to have clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Perhaps there is a way you can remove me from that service? Cheers!

Hey there I am so glad I found your blog page, I really found you by mistake, while I was browsing on Askjeeve for something else, Nonetheless I am here now and would just like to say thanks a lot for a fantastic post and a all round exciting blog (I also love the theme/design), I dont have time to read through it all at the minute but I have book-marked it and also added in your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the superb b.

Hey there! I’ve been following your web site for a long time now and finally got the bravery to go ahead and give you a shout out from Kingwood Tx! Just wanted to tell you keep up the great job!

I enjoy, lead to I found exactly what I used to be taking a look for. You have ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

Please let me know if you’re looking for a article writer for your weblog. You have some really great posts and I believe I would be a good asset. If you ever want to take some of the load off, I’d absolutely love to write some material for your blog in exchange for a link back to mine. Please blast me an e-mail if interested. Cheers!

What’s up, its pleasant post concerning media print, we all understand media is a enormous source of data.

Heya just wanted to give you a quick heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same results.

With havin so much content and articles do you ever run into any problems of plagorism or copyright violation? My site has a lot of completely unique content I’ve either authored myself or outsourced but it appears a lot of it is popping it up all over the web without my authorization. Do you know any methods to help stop content from being ripped off? I’d truly appreciate it.

I constantly spent my half an hour to read this website’s posts every day along with a cup of coffee.

We are a gaggle of volunteers and starting a new scheme in our community. Your web site provided us with useful information to work on. You have performed an impressive activity and our whole group will be grateful to you.

I read this article fully regarding the comparison of newest and preceding technologies, it’s awesome article.

I am in fact glad to read this webpage posts which consists of lots of useful information, thanks for providing such information.

Thank you for sharing your info. I truly appreciate your efforts and I am waiting for your next post thank you once again.

If some one needs to be updated with most up-to-date technologies after that he must be pay a visit this website and be up to date everyday.

Link exchange is nothing else but it is simply placing the other person’s blog link on your page at proper place and other person will also do same in favor of you.

It’s very easy to find out any topic on net as compared to books, as I found this piece of writing at this site.